Does Walmart take Afterpay?

No. Walmart no longer accepts Afterpay since 2021. However, there’s a workaround that allows you to indirectly use this payment solution in your favorite retailer.

The convenience of making flexible payments in an installment plan has become increasingly popular, and Afterpay is one of the leading solutions.

How can you use Afterpay for your Walmart purchases?

I’ll let you in on an indirect solution.

In this article, I’ll explain everything to know about Walmart, Afterpay, and other buy now, pay later services.

Let’s dive in.

What Is Afterpay and How Do You Use It?

Afterpay is a digital payment platform that lets eligible shoppers avail installments at participating retailers.

Users can sign up for a free account and purchase from online or physical shops using the Afterpay app. It allows customers to buy now and pay later in four installments over a six-week period.

Too give you a better picture, here’s how it works, in general:

You sign up for an Afterpay account and connect your digital card with your Apple Wallet or Google Wallet.

You shop through the app or shops that accept Afterpay.

You pay 25% of the total purchase amount for your first payment.

Afterpay charges the remaining 75% in three separate transactions over the course of six weeks. This comes out to 25% every two weeks.

You do it all over again.

Afterpay does not charge interest or fees as long as you pay on time. However, it’s important to use Afterpay responsibly and avoid over-committing financially.

Is Afterpay A Good Way To Finance Purchases?

It depends on your situation. If you’re somewhat financially responsible, it’s worth checking out.

Some of its benefits are:

Afterpay allows you to buy essentials in installments, so you don’t have to pay the full amount upfront.

It can be an alternative to saving money with the added benefit of getting your desired purchase right now.

The platform doesn’t charge interest, which means you’re not spending more.

It’s easy to set up, and it’s ready to use almost instantly.

Afterpay has seamless integration with select stores.

It rewards responsible behavior by increasing the spending limit.

The app can be a useful financial tool if you can use it wisely. However, you must be careful and deeply consider whether you need to use it or now.

5 Things To Consider If You’re Planning To Use Afterpay

Here are some of the factors you need to consider when using Afterpay:

1- Shop Wisely and Responsibly.

When using Afterpay, think carefully about what you’re buying. It’s best to stick to essential items and stay within your budget. Avoid impulsive purchases and prioritize your needs over wants.

2- Make Timely Repayments.

Be sure to meet the payment schedule and fulfill your obligations promptly. This helps you maintain a good payment history and potentially increase your spending limit.

3- Watch Out for Late Fees.

Late payments can lead to additional charges and compound quickly. Setting reminders or notifications can help you stay organized and prevent unnecessary charges.

4- Confirm Store Acceptance.

Not all retailers use Afterpay, so it’s important to check if the retailer you plan to shop at supports this payment method. This way, you can ensure a smooth and hassle-free shopping experience.

5- Assess Your Budget.

Before using Afterpay, take a close look at your overall financial situation.

Consider your income, expenses, and any existing financial commitments. Make sure that adding Afterpay payments aligns with your budget and won’t put undue stress on your finances.

By keeping these points in mind and making responsible decisions when using Afterpay, you can enjoy the flexibility of deferred payments while maintaining control over your financial well-being.

Does Walmart Take Afterpay Online or In-Store?

No, Walmart doesn’t let you pay with Afterpay directly.

However, the retailer accepts other buy now, pay later (BNPL) services. I’ll discuss them in more detail later.

If you want to use Afterpay specifically, here’s what to do.

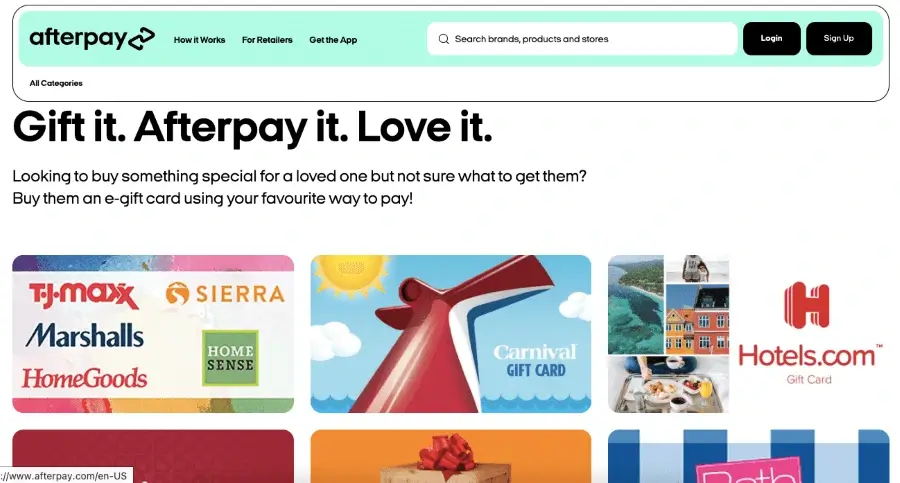

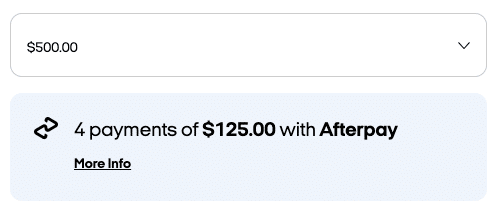

Can You Use Afterpay at Walmart To Buy Gift Cards?

Yes, you can use Afterpay to buy a Walmart gift card. Afterpay also lets you split the total cost into four.

However, not everyone has access to gift cards, depending on various factors like:

Consistent, on-time repayments

Account tier

Pulse Rewards enrollment

How long you’ve been an Afterpay customer

How To Use Afterpay at Walmart Gift Cards

1- Open your Afterpay app or log in through the browser.

2- Browse the gift card section and select Walmart.

3- Choose an amount.

4- Choose the recipient: yourself or a friend.

5- Wait for the email confirmation.

6- Wait for the second email from Prezzee, the e-Gift card supplier.

Can I Use Afterpay at Walmart Online Using Gift Cards?

Yes, the Walmart e-gift card you buy through Afterpay is valid in Walmart’s physical stores or Walmart.com.

Here’s how to use your Walmart gift cards:

How Can You Use Afterpay In-Store at Walmart with Gift Cards?

Get the items you want and proceed to the counter.

Inform the cashier you’re paying with a gift card.

Provide your gift card details from Afterpay and Prezzee.

If the balance doesn’t cover the total purchase amount, you can pay the difference with cash, debit card, or credit card.

Finalize the transaction and get your receipt.

How Do You Use E-Gift Cards from Afterpay on the Walmart Website?

Add your desired items to your cart and proceed to the checkout page.

Enter your pickup or delivery information.

Select Gift card as your chosen payment method.

Enter your gift card number and PIN (check Prezzee’s email to get your PIN).

Click Apply Gift Card.

Why Doesn’t Walmart Accept Afterpay Financing?

It’s unclear why Walmart doesn’t use Afterpay as a payment solution. However, various factors could influence Walmart’s decision.

Their choice might stem from their business strategy, where they prefer partnering with other payment providers that align better with their goals.

Additionally, accepting Afterpay could bring additional charges, like transaction fees or system integration expenses. Walmart likely evaluated these costs and determined they outweighed the potential benefits.

Furthermore, Walmart already offers a range of payment options, including other Buy Now, Pay Later services alongside traditional methods.

They might have found these options to cater to their customer’s needs and preferences sufficiently. Ultimately, Walmart’s decision could result from business strategy, cost analysis, and market research.

What Financing Solutions Can You Use To Pay at Walmart?

Unfortunately, common payment methods like Apple Pay aren’t also available.

Although Afterpay is not an option, Walmart actively offers customers a variety of payment solutions. Here are some of the available options:

Debit cards

Credit cards

Gift cards (except for another gift card)

Walmart Pay

PayPal

Capital One Walmart Cards

EBT cards (for EBT eligible items)

Benefit cards (for eligible items)

Note that not all payment solutions may be available for every Walmart purchase.

In such cases, customers will need to provide an alternative payment solution for items ineligible for financing. Additionally, certain payment options may have spending limits.

Customers should check their local Walmart store and the respective payment provider to get the most accurate and up-to-date information on payment solutions and limits.

What about financing options? I’ll detail those below.

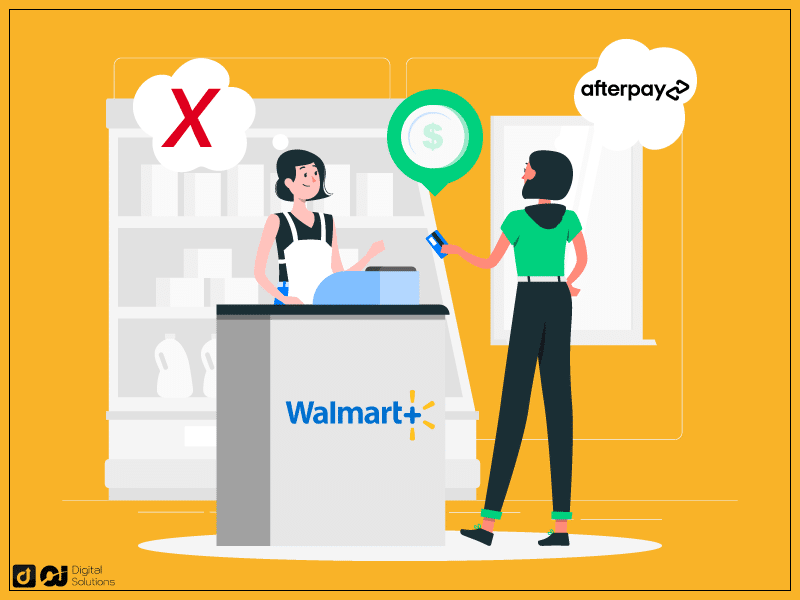

Can You Use Affirm To Pay at Walmart?

Yes, Walmart customers can pay using Affirm for online and phyical transactions.

Here’s how it works for store purchases:

Visit the Affirm.com/walmart website.

Choose a payment plan (from three to 24 months).

Scan the single-use barcode at the register.

For website purchases, you can simply choose Affirm as the payment option when checking out.

Affirm displays the precise terms and the total interest amount without any hidden fees.

However, it has varying interest rates with occasional 0% APR deals.

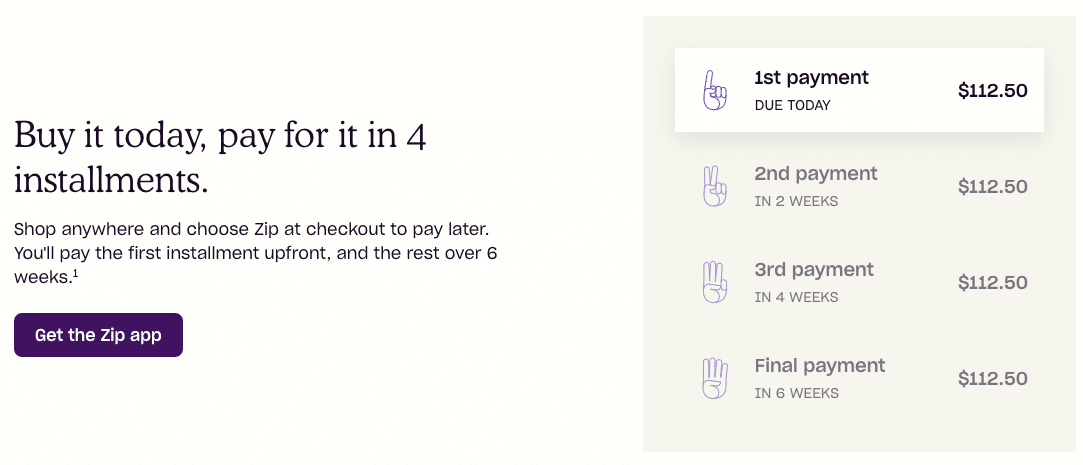

Can You Use Quadpay at Walmart?

Yes, Walmart actively accepts Zip, formerly Quadpay.

Zip lets customers divide their purchases into four interest-free payments over a span of a six-week period.

If you wish to use Zip Pay in Walmart stores, follow these steps:

Open the Zip app and request for an In-store purchase.

Open Walmart’s app and input your Zip virtual card details in Walmart Pay.

Choose Zip Virtual Card as your payment method.

Scan the QR code at the register.

Note: You must make a request for every new transaction.

Can You Use PayPal Pay in 4 at Walmart?

Yes. Paypal’s Pay in 4 allows you to checck out your Walmart purchases in four interest-free installments.

However, you can only use this service on the website. Here’s how to use it:

Link your PayPal account to your Walmart.com account.

Choose Pay in 4 as your preferred payment option when checking out your items.

Note: Pay in 4 is different from other PayPal financing services, such as Pay Monthly and PayPal Credit.

Does Walmart Do Afterpay or Klarna?

As mentioned, Walmart doesn’t accept Afterpay. With Klarna, it’s a little bit complicated.

You may not be able to use Klarna in Walmart stores, whether physical or online. However, Klarna provides a way through its app so you don’t miss a good deal at Walmart.

Here’s how it works:

Open the Klarna app and search for Walmart at the home page.

Add items to your cart and check out.

Tap the Pay with K button.

Like Afterpay, Klarna allows you to split the total amount into four installments, paid every two weeks.

Does Walmart Have a Buy Now, Pay Later Option?

Walmart plans to launch a new BNPL service that will allow shoppers to apply for financing as they check out, which could be approved in minutes.

While the details of this service are not yet clear, Walmart has reportedly been backing a fintech startup that plans to launch this BNPL service.

In the meantime, you can use the available BNPL services while waiting for Walmart’s integrated finance solution.

What Can You Buy At Walmart Using Buy Now, Pay Later?

You can buy a wide range of items at Walmart using Buy Now, Pay Later.

Some of the eligible categories include the following:

- Electronic

- Video games

- Toys

- Home products

- Arts & crafts supplies

- Musical instruments

- Home improvement items

- Automotive products

- Sports & outdoors home improvement

- Tools

- Baby products

- Jewelry

- Apparel

What Items Are Not Eligible for Buy Now, Pay Later at Walmart?

When using BNPL services at Walmart, there are certain categories of items you cannot purchase.

These ineligible categories include the following:

Alcohol

Baby consumables

Gasoline

Groceries & food

Merchandise at the register

Miscellaneous supplies

Money services

Personal care products

Pet supplies

Pharmacy items

Health & wellness products

Temporary specialty items

Tobacco

Weapons

Ammunition

Air guns

Gun accessories & hunting supplies

Wireless service plans

1-hour photo services

These items have specific restrictions or regulations that prevent them from being eligible for buy now, pay later services.

Is It Possible To Split Payments at Walmart?

Yes, Walmart allows customers to split payments on purchases using multiple forms of payment. Here are some ways to split costs at Walmart:

Pay with a combination of cash, check, credit card, or gift card at the register.

Use the Walmart Pay app to split payments between different payment alternatives.

Additionally, there may be limits to how many gift cards or payment alternatives you can use for a single transaction.

Frequently Asked Questions (FAQs)

Do I Need To Pay Interest If I Use Buy Now, Pay Later at Walmart?

It depends on your chosen finance provider.

aIf you shop with Affirm, you must confirm the rate before finalizing the transaction. On the other hand, Zip Pay, Klarna, and Pay in 4 don’t charge interest.

What Are Some Popular Stores That Accept Afterpay?

Various stores use Afterpay, including the following:

Adidas

Anthropologie

Asos

Bed Bath and Beyond

Buy Buy Baby

Calvin Klein

Carters

CVS

Dick’s Sporting Goods

Dillard’s

DSW

Finish Line

Forever 21

GameStop

Houzz

Lululemon

MAC Cosmetics

Nike

Pier 1

Sephora

Ulta Beauty

Urban Outfitters

Zara

This isn’t an exhaustive list, and many other stores accept Afterpay. Check with the specific shop and location beforehand to ensure they support Afterpay for purchases.

What Are Afterpay Alternatives?

Several companies also offer monthly installments. Here are some other buy now, pay later options:

Klarna App

Affirm

Zip

PayPal Pay in 4

Sezzle

Is Affirm Better Than Afterpay?

Affirm and Afterpay offer similar services, but there are some differences.

Afterpay is available to anyone with a credit or debit card and doesn’t charge interest if you make timely repayments.

Affirm requires a credit check, offers more flexible payment plans, and may charge varying interest.

Availability varies for both services, so the best choice depends on personal preferences and credit history.

Does Walmart Accept Afterpay In-Store and Online for Groceries?

No, Walmart doesn’t accept Afterpay for paying for your groceries or any purchases. As mentioned, Walmart offers a buy now, pay later service called Affirm, but you can’t use it for buying grocery items at Walmart.

The Bottom Line

Walmart doesn’t currently accept Afterpay as a payment solution for purchases.

However, Walmart offers alternative buy now, pay later services such as Affirm, Zip, and PayPal Pay in 4. These services also allow customers to split the total amount into manageable installments.

Remember to check the availability and terms of your chosen payment solution before making a purchase. Assess your financial situation, as well, to prevent impulse buying.

I hope you found this blog informative. I’d love to know more about your thoughts on Walmart payment solutions.

Have you used any buy now, pay later services before? Let us know in the comments below!