The 8 Best Accounting Software For Amazon Sellers

-

By Omar Deryan

- Updated on

As an Amazon seller, you have a lot of moving parts to keep track of. You’ve got your inventory, your P&L, your customers… the list goes on. And if you’re selling in multiple countries, you’ve got even more to think about.

You need to keep track of your expenses, profits, and taxes. This can be a daunting task, especially if you are not familiar with accounting software.

There are many different accounting software programs available.

They are all beneficial in some way and have different features, but which is the best amazon accounting software?

In this guide, I reviewed and ranked the 8 best accounting software for Amazon sellers, explain how each of them can help you keep your business finances organized, and help you choose the right accounting software for your business.

Here are the top 5 accounting software options for Amazon sellers at a glance:

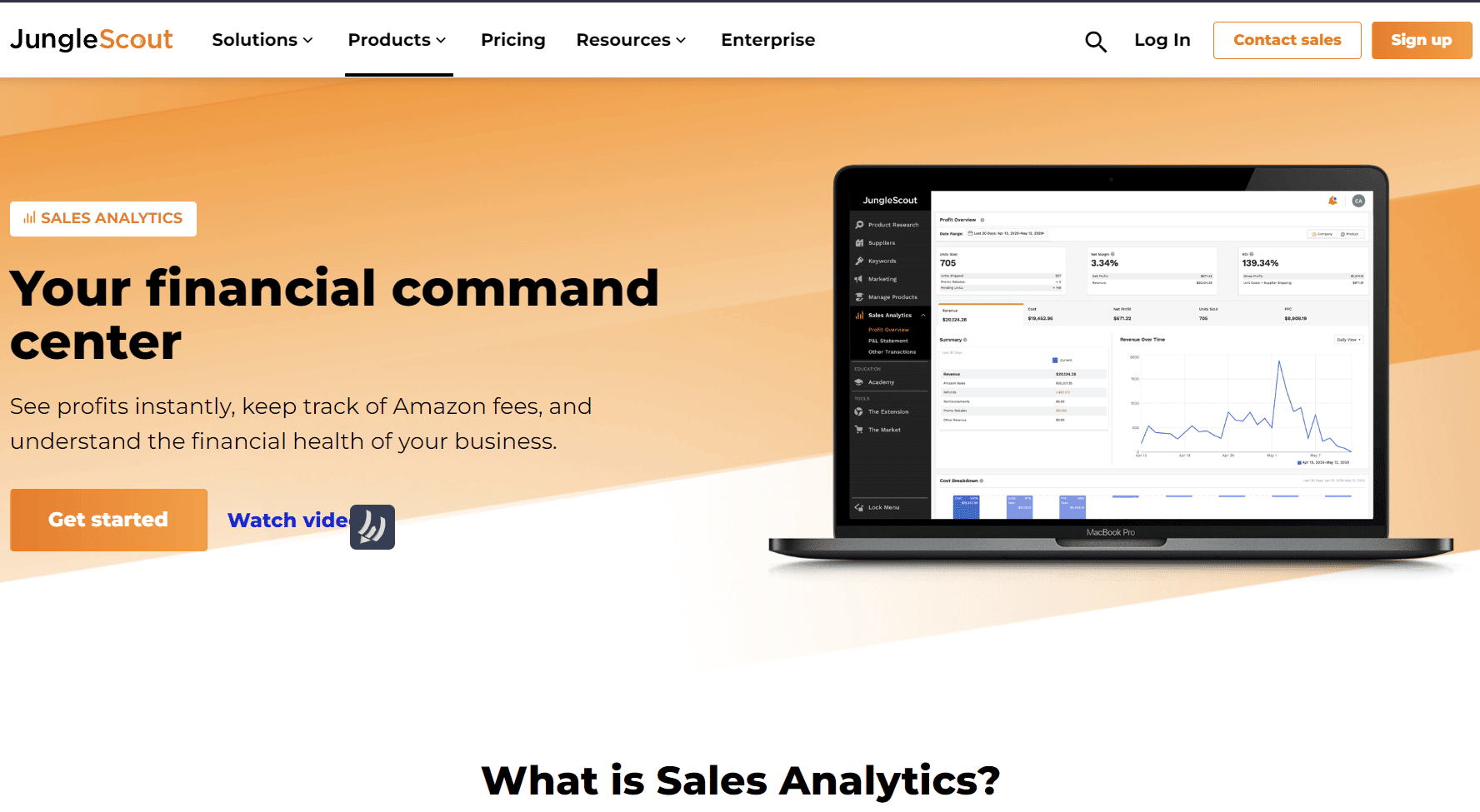

As part of Jungle Scouts’ package, the Sales Analytics allows you to conveniently track your Amazon fees, sales, and other costs, all in real-time.

This online bookkeeping solution helps eCommerce and digital firms better manage and comprehend their accounting and finances.

Taxomate connects with your Amazon accounting software and your eCommerce seller accounts. Excellent option to automate your eCommerce bookkeeping.

Xero is a cloud-based accounting software that supports an infinite number of users, and has hundreds of app integrations for a unique automation stack.

Local accountants support ecom companies in becoming VAT compliant when selling items on various platforms and marketplaces like Amazon.

Table of Contents

What Is Accounting Software?

Accounting software is a computer program that helps you manage your finances. It can be used to track your income and expenses, reconcile your bank statements, and generate financial reports.

Quality accounting software is an essential tool for any business, but it can be especially helpful for Amazon sellers.

There are a number of accounting software programs available, but not all of them are created equal. When choosing an accounting program, it’s important to consider your specific needs as an Amazon seller.

For example, if you sell on multiple Amazon marketplaces, you’ll need a program that can track your sales and expenses in each country.

Why Do Amazon Sellers Need Accounting Software?

Accounting and bookkeeping are an essential part of being an Amazon seller.

Without accurate financial records, it would be difficult to properly manage your business and make informed decisions about your inventory management, pricing, and other important factors.

First, you need to know your expenses so that you can track your profits and determine how much money you are making. Secondly, you need to keep track of your taxes.

Amazon sellers are required to pay state and federal taxes on their sales, and if you do not keep accurate records, you may end up owing more sales tax than you should

Also, good financial records can help you get approved for loans or lines of credit from banks or other lenders. Without proper documentation of your income and expenses, it would be difficult to get approved for a loan.

If you know how much money you are making and where your money is going, you can find the best ways to grow your business.

Amazon accounting software can generate reports that will show you your biggest expenses, most profitable products, and other important information that can help you make informed decisions about your ecommerce businesses.

Factors To Consider When Choosing Accounting Software For Your Amazon Business

Not all accounting software programs are created equal. When choosing an accounting program, it’s important to consider your specific needs as an Amazon seller.

Here are things to look for in accounting software:

- The price: There are a number of free and paid accounting software programs available. The price is often based on the features and complexity of the program. You’ll want to find a program that fits within your budget.

- Ease of use: Choose a program that is easy to use and navigate. It should have a user-friendly interface so you can quickly find the information you need. The last thing you want is to be stuck using a complicated program that’s difficult to navigate.

- Compatibility: Make sure the accounting software is compatible with your operating system and other software programs you use, such as your Amazon seller account.

- Features: Consider the features you need, such as the ability to track multiple bank accounts, generate financial reports, or reconcile your Amazon sales.

- Customer support: Choose a program that offers customer support in case you have questions or need help using the software.

- Free trial: Many accounting software programs offer a free trial so you can try before you buy. This is a great way to see if the program is a good fit for your needs.

What Are The Benefits of Ecommerce Accounting Software?

Ecommerce accounting software provides a number of benefits for Amazon sellers. These include:

- Increased revenues: Ecommerce accounting software provides you with the tools you need to track your inventory, sales, and expenses. This information is critical in understanding where your business is making and losing money.

- Improved cash flow: By tracking your income and expenses, you can better manage your cash flow with forecasting software. This will help you avoid common pitfalls that can lead to business failure, such as running out of money to pay your bills

- Reduced costs: Ecommerce accounting software can help you save money by automating repetitive tasks, such as invoicing and tracking payments. This will free up your time so that you can focus on more important tasks, such as growing your business.

- Improved decision-making: By having access to accurate financial information, you can make better decisions about where to invest your time and money. This will help you grow your business more quickly and avoid costly mistakes.

- Enhanced customer service: Ecommerce accounting software can help you keep track of your customer orders and contact information. This will allow you to provide better customer service and build long-term relationships with your customers.

- Increased efficiency: Ecommerce accounting software automates many of the tasks associated with running an online business. This will save you time and allow you to focus on more important tasks, such as marketing and product development.

What Are Some Drawbacks of Ecommerce Accounting Software?

There are a few drawbacks of ecommerce accounting software to consider:

- Complicated setup: Some accounting software programs can be complicated to set up and use. This can be a deterrent for some small business owners who don’t have the time or patience to learn how to use the software.

- High cost: Some accounting software programs can be expensive, especially if you need features that are only available in the premium versions. This can be a problem for small businesses that are operating on a tight budget.

- Limited features: Some accounting software programs offer only basic features. If you need more advanced features, such as the ability to track inventory or generate financial reports, you may need to look elsewhere.

Best Accounting Software For Amazon Sellers

Let’s take a look at the top accounting software options for Amazon sellers:

Omar's Take

Effective Amazon sales analysis software frees you up to concentrate on increasing your company’s profitability. The Sales Analytics tool from Jungle Scout offers a solution.

Sales Analytics allows you to conveniently track your Amazon fees, sales, and other costs, all in real-time.

-

Best For Any Amazon Seller

-

Price Starting at $29/mo

-

Annual Discount Yes, save 73% to 81%

-

Promotion 7-day Risk Free Money Back Guarantee

Sales Analytics is a software that comes as part of the JungleScout package. It was previously called the fetcher accounting software.

Using the real-time organization and tracking provided by Sales Analytics, you can concentrate on cost-cutting and profit-building tactics to increase your Amazon revenue.

It provides a thorough review that helps you comprehend the state of your company’s finances.

Profit Overview allows you to monitor both historical and recent sales data, view information down to the product level, and tailor your expenses by adding negative or positive entries particular to your company.

You may also track your PPC-related revenues and costs to make future ads more effective.

Key Features

- Multi-product dashboard

- Profit overview

- Tax management

- Profit and Loss statement

- Customized expenses

- Management of PPC-related expenses

Pricing Plans

- Basic: $29 per Month

- Suite: $49 per Month

- Professional: $84 per Month

Pros and Cons of JungleScout

Here’s what I like and dislike about JungleScout.

Pros

- To see how well a product is selling, you can filter sales data by ASIN, SKU, or product name.

- You can monitor your sales in real time.

- You can view your exact net profit using the margin widget.

- There are detailed charts that enable you to compare performance over time.

- You can create custom reports that are unique to your business.

Cons

- You can only access this software by purchasing one of the JungleScout packages.

Omar's Take

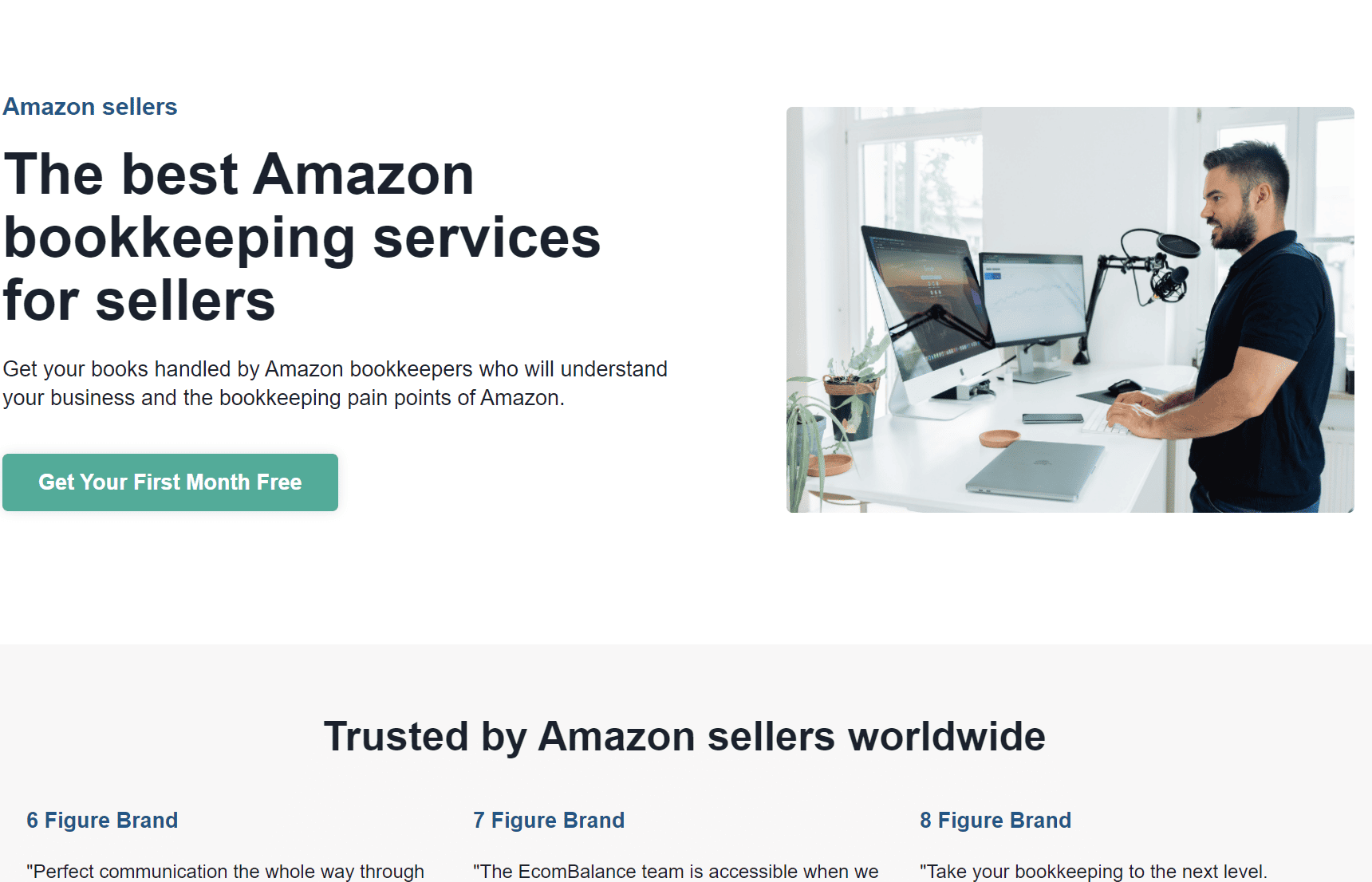

This online bookkeeping solution helps eCommerce and digital firms better manage and comprehend their accounting and finances.

The company founders are very active and take care of every customer, which makes this software extremely reliable.

-

Best For A Growing Amazon Business

-

Price Starting at $249/mo

-

Annual Discount No

-

Promotion Special Discount

This monthly online bookkeeping solution helps eCommerce and digital firms in better managing and grasping their accounting and finances.

This program helps you understand your business by taking care of the bookkeeping.

The online bookkeeping software for Amazon sellers offers monthly, personalized analysis to help you comprehend your data and make more informed decisions.

Key Features

- Profit and loss reporting, Balance Sheet, Cash Flow Statement

- Year-end Tax Ready Financial Statements

- Fast Support Via Email, Text, and Video Calls

- Books on Time, by the 10th to the 15th of each month – Never worry about getting your books on time.

- A Committed Ecommerce Bookkeeping Team – As your company expands, establish a relationship with the EcomBalance bookkeeping team with accounting background.

- Effective Communication with Your CPA for Taxes – They directly collaborate with your CPA to build the best finance team for your company.

Pricing Plans

- 6 Figures: From $249 per month

- 7 Figures: From $399 per month

- 8 Figures: From $799 per month

- Custom Pricing available

Pros and Cons of EcomBalance

Here’s what I like and dislike about EcomBalance.

Pros

- Provides a great team with accounting background to work with

- Top-notch accounting and bookkeeping services

- Easy to communicate with as they are very responsive

Cons

- Costly service for small business owners

Omar's Take

Your Amazon accounting software and your eCommerce seller accounts are connected by Taxomate.

If you want to automate your eCommerce bookkeeping, this is an excellent option.

-

Best For Easy Automations

-

Price Starting at $12.00/mo

-

Annual Discount 2 Months Free

-

Promotion 14-Day Free Trial

Taxomate is an accounting software for Amazon FBA sellers designed to streamline your business’s finances.

To import order sales from amazon seller accounts, the taxomate solution links the Amazon Seller Central account with QuickBooks and Xero.

With this automatic method of importing orders, spreadsheets and manual double-entry accounting are eliminated.

Key Features

- Perfectly Balance Books

- Unlimited Accounts

- Unlimited Marketplaces

- Multicurrency Support

- Time-saving Automation

- Bank-grade Security & Encryption

- Cost of Goods Sold

- Inventory Valuation

- 1:1 Onboarding Support

Pricing Plans

- Starter: $12

- 1K plan: $20

- 5K plan: $37

Pros and Cons of Taxomate

Here’s what I like and dislike about Taxomate.

Pros

- QuickBooks account settlements from Amazon sellers can be imported the simplest way possible.

- The onboarding process is simple.

- Fully automated accounting is offered for both Fulfillment by Merchant (FBM) and Fulfillment by Amazon (FBA).

- Is a more price-friendly solution compared to other Amazon FBA accounting software options.

Cons

- The mapping might use some improvement.

- Not compatible with Quickbooks desktop.

Omar's Take

Small businesses and accountants were considered in the design of this accolade-winning accounting software.

The Xero accounting software is similarly a cloud based accounting software that supports an infinite number of users, and has hundreds of app integrations for a unique automation stack.

-

Best For Beginners

-

Price Starts at $22.00/mo

-

Annual Discount No

-

Promotion 30-Day Free-Trial

In order to aid small enterprises, Xero was established in 2006. It now has more than 1.8 million subscribers globally and assists them in calculating their sales tax on an annual basis during tax season.

Multiple Amazon FBA sellers can utilize this accounting software from a single account, based on your membership plan.

It features support for numerous users, financial reports, sales tax calculation, sales tax preparation, and credit card transaction data.

Best of all, you don’t need prior accounting knowledge.

Key Features

- Send invoices – Use this simple billing software to work smarter. As soon as the work is finished, send online invoices from a desktop or mobile device.

- Bank reconciliation – Utilizing recommended matches, categorize and reconcile daily bank account activities.

- Pay bills – Pay your bills and obtain a comprehensive picture of your cash flow and accounts payable.

- Expense claim – Record costs to file and refund expense claims as well as to keep track of spending.

- Bank connections – Set up bank feeds and connect your bank to Xero for transactions to flow safely.

- Payroll – Use online payroll software to pay employees and submit payroll information to the ATO.

- Reporting – Monitor your money with precise accounting reports and work in real time online with your advisor.

- Inventory – Add your purchases and sales to invoices and orders.

- Purchase orders – Track orders and deliveries at every stage with purchase orders.

Pricing Plans

- Started: $22 per Month

- Standard: $35 per Month

- Premium: $47 per Month

Pros and Cons of Xero

Here’s what I like and dislike about Xero.

Pros

- This software streamlines the management of sales taxes for Amazon sellers.

- It can be utilized on a variety of platforms, including commercial mobile apps.

- Compatible with accounting programs made to work with Amazon FBA accounts.

Cons

- Xero could appear a little more straightforward than other Amazon seller software such as QuickBooks.

Omar's Take

Local HelloTax accountants support e-commerce companies in becoming VAT compliant in the EU when selling items on various platforms and marketplaces like Amazon.

-

Best For European Seller

-

Price Starts at €39.00/country

-

Annual Discount No

-

Promotion No

Hellotax automates VAT for European online retailers.

With the help of the in-house created tax software, it is now possible to complete all necessary chores quickly, including registrations, track sales tax calculations, compliance with the authorities, inventory movement, and monitoring of all thresholds, among many other things.

Additionally, for quality control and the finest process possible, the company hires its own tax accountants in every European nation.

Key Features

- EU VAT Returns

- VAT Registration

- EU OSS Reports & Filings

- Automated VAT Compliance

- Financial accounting

- EC Sales Report

- Annual statements

- Management, process and business consulting

- Analysis of accounting processes

- Payroll accounting

Pricing Plans

- New Seller: $39

- Established Seller: $99

- 5 Countries Pack: $599

- VAT Resistration: $300

Pros and Cons of HelloTax

Here’s what I like and dislike about HelloTax.

Pros

- The software simplifies the handling of a very challenging VAT process.

- Excellent and prompt customer service

- Automates VAT calculations for smooth management

Cons

- Exporting and importing of files may be challenging

Quickbooks

Omar's Take

The most adaptable accounting software is QuickBooks Online, which enables many users and locations to see their company’s money from any location at any time.

-

Best For Enterprise Sellers

-

Price Starts at $30/month

-

Annual Discount N/A

-

Promotion Free trial for 30 days OR 50% for the first 3 months

QuickBooks Online provides all the resources required for ecommerce sellers that frequently move a lot of goods through an Amazon site to increase inventory and revenues.

If Amazon isn’t their only source of revenue, QuickBooks Web capabilities enable sellers to manage various online sites.

You’ll also appreciate how much time you will save and the increased control you’ll get from having all of your clients’ financial data in one convenient location online.

Features

- Accounts Payable – QuickBooks Online Basic provides you with all the tools you require to keep track of your spending and print official checks.

- Accounts Receivable – The system will let you set up customer accounts to save data about each client and enable easy invoice customers.

- Employee Time Tracking by Customer – With this feature of QuickBooks Online, you may grant time-entry access to staff members, allowing them to independently record their time into the system.

- General Ledger – The general ledger in QuickBooks Online allows you to keep track of your transactions, report on your performance, and create budgets.

- Payroll for QuickBooks Online – This will provide you with a step-by-step manual that explains how to handle payroll.

Pricing Plans

- Simple Start: $16 per month

- Essentials: $25 per month

- Plus: $34 per month

Pros and Cons of Quickbooks

Here’s what I like and dislike about Quickbooks.

Pros

- Personalized reporting enhances workflow

- The latest features make it more adaptable

- You can integrate apps which boosts compatibility

- It includes payroll features that help with management

Cons

- Basic accounting knowledge is need to operate.

- Features boasted of that are irrelevant to Amazon sellers

- Quite pricey subscription packages

Omar's Take

Because it integrates with both QuickBooks and Xero, A2X stands out from the other accounting systems on the list.

The most recent Amazon transactions are retrieved from your account and then condensed into QuickBooks.

-

Best For Mid-sized Amazon Sellers

-

Price Starts at $19/month

-

Annual Discount N/A

-

Promotion Free Trial

Amazon marketplace sales, FBA inventory management accounting processes, and cost of goods sold are automated by the use of A2X Accounting for Amazon sellers.

It automatically displays Amazon settlements and gives you a concise breakdown of revenue, costs, and other information.

Key Features

- Accounting sync that works like magic is provided by A2X – By uploading settlement summaries to Sage, Xero, or QuickBooks, all income and costs are automatically matched with your payouts, ensuring a faultless reconciliation.

- Timely & effective customer service – You’ll receive unmatched support for all of your pressing bookkeeping for Amazon FBA questions with support in all timezones.

- Accounting Accuracy – A2X organizes your books in just a couple of clicks using the correct accrual technique of accounting, providing you a complete image of how value is moving through your firm.

Pricing Plans

- Mini: $19 per Month

- Starter: $49 per Month

- Standard: $69 per Month

Pros and Cons of A2X

Here’s what I like and dislike about A2X.

Pros

- Direct access to inventory valuations through your Amazon account

- You will receive the most up-to-date information about developing your Amazon business using extremely accurate data.

- Your accounting on Amazon will be automated so you can focus more time on increasing sales

Cons

- Everything is done automatically, eliminating the need to manually add entries.

Omar's Take

Freshbooks is a strong cloud-based invoicing module and a relatively economical cloud-based solution with a ton of features.

In order to help Amazon sellers decide how to proceed with sales, FreshBooks also offers simple to configure and generate reports.

-

Best For Econonomical Cloud-Based Solution

-

Price Starts at $4.5/month

-

Annual Discount N/A

-

Promotion Free Trial

This is a cloud-based accounting program for independent contractors and small company owners. The solution’s simplicity and intuitiveness makes business accounting calculations easy and fast.

Create professional invoices, record your outlays, and monitor your time spent on tasks.

Additionally, because all of your data is safely kept in the cloud, you can work on any device you choose, wherever you are.

Key Features

- Balance Sheet

- Trial Balance

- General Ledger

- Accounts Payable

- Cost of Goods Sold

- Chart of Accounts

- Accountant Access

- Journal Entries

Pricing Plans

- Lite: $4.50 per month

- Plus: $7.50 per month

- Premium: $15 per month

- Custom: Depends on clients’ requirements

Pros and Cons of Freshbooks

Here’s what I like and dislike about Freshbooks.

Pros

- Reasonable price ranges

- Comprehensive invoicing features

- Outstanding user experience

- Simple to use

Cons

- Does not have sufficient accounts payable features.

- The software becomes obsolete as a business moves on to the next phase of growth due to its limited capability.

FAQs

Do I really need accounting software for my small Amazon business?

Yes, you do. While you can run your business without accounting software, it’s not recommended. Accounting software provides you with the tools you need to manage your finances and grow your business.

Without it, you may find yourself struggling to keep track of your income and expenses, which can lead to cash flow problems.

It is best to invest in accounting software as soon as possible so that you can avoid these problems down the road.

How much does accounting software cost?

The cost of accounting software varies depending on the features you need.

Basic programs can start as low as $15 per month, while more advanced programs can cost up to $100 and above per month. There are even free accounting software options available on the market.

Many accounting software programs offer a free trial so you can try before you buy. The cost varies depending on the features you need.

What are the most important features of accounting software?

The most important features of accounting software vary depending on your needs.

However, some essential features to look for include the ability to track income and expenses, manage inventory, generate financial reports, and automate repetitive tasks.

For larger Amazon businesses, you may also need features such as the ability to track customer orders and contact information.

Can I use my personal accounting software for my business?

You can use your personal accounting software for your business, but it’s not recommended. Personal accounting software is designed for individuals, not businesses.

As such, it may lack features that are essential for businesses, such as inventory tracking or generating financial reports.

Additionally, personal accounting software may not be able to handle the increased volume of business transactions associated with running a business.

The Bottom Line

Accounting software for Amazon sellers is a great resource in the eCommerce industry. It can save you time and money, and help you grow your business more quickly.

However, it’s important to choose the right software for your needs, as some programs can be complicated to set up and use.

Any of the software options on this list would be a great choice, but obviously, some will be more effective for you and your company than others.

Specify the features you require, and identify your needs, whether that is support with shipping or inventory management, assistance with tracking sales tax, etc.

This guide is a great place to start when narrowing your choices and selecting the accounting software that will work best for you and your business.

And if you’re looking for a list of more tools related to Amazon, check out our full guide about the best amazon seller tools in the market.

Omar Deryan

Founder of OJ Digital Solutions