Investors have been putting billions of dollars into the Amazon marketplace in recent years.

How? They acquire Amazon brands and put them all under one roof.

This is called the Amazon aggregator business, one of the fastest-growing markets in the ecommerce world.

But what does it mean for your Amazon store? Will it affect your profitability? Should you sell your business? Which firms should you watch out for?

This guide will help you answer all of those questions.

What Are Amazon Aggregators?

Amazon aggregators are investment firms that acquire businesses and provide resources to turn them into successful and profitable brands. Their access to substantial capital puts them in an excellent position to help develop small Amazon FBA businesses.

Comprised of e-commerce specialists, Amazon veterans, and industry-leading professionals, aggregators leverage their marketing and logistical expertise to elevate brands.

In return, they create compelling digital marketing and development strategies for Amazon brands. These can range from private-label to environmentally-conscious brands, with hundreds of product categories in between.

What Amazon Aggregators Are Looking for in a Business

Each Amazon aggregator will have its own set of standards. However, here are some minimum requirements that you should meet:

Fulfilled by Amazon (FBA) Brand

Fulfilled by Amazon (FBA) is a service that enables sellers to outsource order fulfillment to Amazon. Amazon sellers ship products to fulfillment centers, and then Amazon will choose, pack, and ship the order when a purchase is made.

Generally speaking, aggregators are interested in acquiring private label brands. This is because their logistics are more streamlined, and they are more likely to get Prime status.

How Many Sales Were Made Through Amazon?

Amazon sellers often list their products on third-party sites like Etsy, eBay, and Shopify. While that may be a common practice, many aggregators prefer to acquire brands that make most of their sales on Amazon.

The magic number differs for each aggregator. Some are fine with at least 30% of Amazon-generated income, while others look for 75 to 80%.

Profitability

Most Amazon brand aggregators are looking for ecommerce stores that profit at least $200,000 annually. Some will accept net margins of as low as 10%, but most recommend a minimum of 15%.

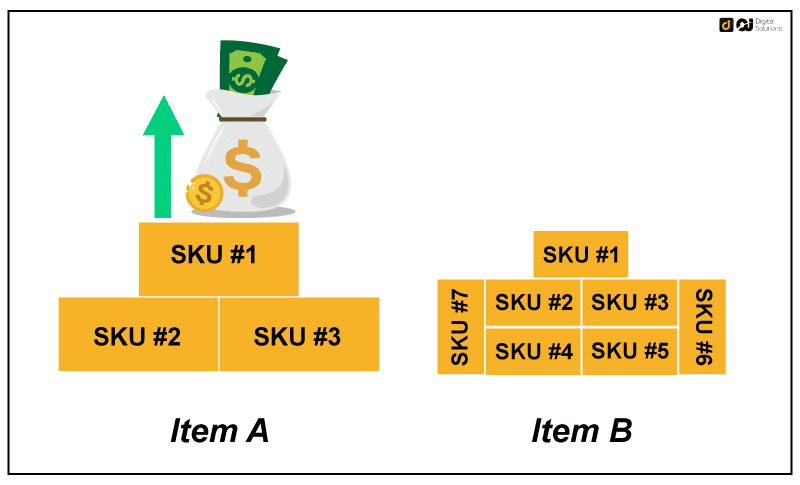

Number of Revenue-Generating SKUs

FBA brands with fewer SKUs of quality products are highly appealing to aggregators. For instance, $1 million in revenue with 1-2 SKUs is better than $1 million in sales with 50 SKUs.

Customer Loyalty

A devoted customer base is always an excellent indicator that a business performs well. This shows that a business makes efforts not only to generate sales but also to build good relationships with its customers. The latter is crucial to growth.

Constant Product Demand

Aggregators are looking to create long-term partnerships with quality brands with high consumer demand. They don’t like success that comes in waves like trends. They want businesses that can be successful for a long time.

Specialized Niche

Each aggregator has a distinct niche interest based on its expertise. With that said, you don’t need to force yourself to expand to categories you aren’t well-versed in. It’s perfectly fine to stick with what you’re good at and focus on growing that.

Amazon FBA Aggregators Business Model

Aggregators often buy Amazon FBA businesses with the intention of increasing their presence within the ecosystem. However, the overall goal is to use Amazon as a springboard to expand them into other channels.

Companies brought under the wing of skilled consolidator groups have a rock-solid foundation for growth thanks to Amazon’s ecosystem, global connectivity, and enormous customer base.

Aggregators follow tedious processes to decide whether or not a company will be valued. This helps them avoid companies that initially show a lot of potential but plateau after some time.

Additionally, aggregators conduct comprehensive research on a brand before considering whether or not to make an offer. They explore Amazon with the help of data science to find strong investment opportunities, and then they sift through hundreds of potential businesses for the best of the best.

Tools are crucial in this part of the process. When combined with the expertise of their personnel, these tools help them identify companies that would show the most promise.

However, they may also go out of their way to learn more about your brand while they are in the process of purchasing it.

Hence, it is common for aggregators to ask the founding owners to become a part of the firm to serve as a consultant. This is done to keep the company moving in the right direction.

Knowing Your Business Value Before Selling to an Aggregator

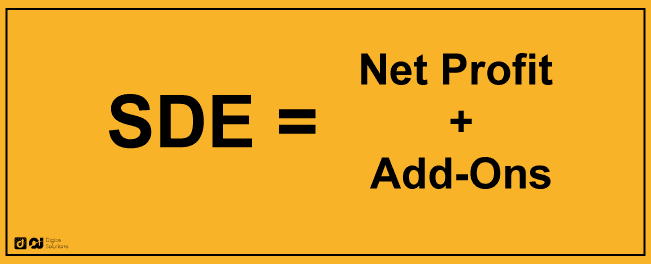

Suppose you’re running a small to medium-sized Amazon FBA business, and you’re thinking about selling it. To do that, you need to be familiar with the Seller’s Discretionary Earnings (SDE) and how it’s calculated.

SDE translates to the cash flow a business has generated over a year. The SDE calculation formula is:

Calculating this will give you a better understanding of your firm’s annual sales and profits. It also shows you a clear view of its value and performance marketing, which is conducive to increasing its value in the future.

Keep in mind that while SDE assesses the company’s profits, it does not include earnings before depreciation, amortization, income taxes, and so on. This is important to aggregators as it gives them a reliable estimate of the amount they will acquire after buying your firm.

When Should I Sell My Amazon Business?

It isn’t uncommon for sellers to feel that their business has hit its growth ceiling. However, the truth is that it still has room for expansion in the hands of another entity.

If you strongly believe your business has reached its maximum potential, you should consider selling it to an aggregator. They have the resources, experience, and knowledge to elevate it to even greater heights.

Should You Sell Your Business to an Aggregator?

Before you sell your business, think about if you see it being in demand in the future. Remember that you’re not just selling your business for what it is now but also for what it can be.

Once you’ve decided, carefully prepare your financial records for the eventual sale of your Amazon company. It’s best to do this with an accrual-based system. If you want to make sound decisions for your company, take good care of your business analytics and ensure the data is well-organized and easy to access.

If your Amazon company is thoroughly documented, you will be able to sell it for a better price.

Make sure that all of your operational processes are recorded. Amazon seller accounts with more favorable ratings are in great demand as prospective buyers seek out those with the capacity to climb rankings.

Understanding native Amazon data can be complicated and time-consuming. Using a third-party platform with Amazon data can help you understand the information better.

Advantages of Selling to Aggregators

Many benefits are associated with selling your company to Amazon aggregators. Let’s examine them.

Fast Exit and Profits

One of the most profitable ways for amazon sellers to make more money, is by simply selling their business. That’s why it’s actually one of the most popular goals of amazon businesses, especially with the increasing FBA fees and competition in the amazon marketplace.

Large Funding

Aggregators enable SMBs to expand to the degree that would otherwise be impossible owing to a lack of capital and resources. Since this isn’t an issue with aggregators, the process becomes streamlined.

Proven Expertise

A typical Amazon seller acquisition company will have teams of Amazon specialists that work to expand a brand with data-driven technology. Leading aggregators often select enterprises with worldwide expansion potential.

Increased eCommerce Performance

Aggregators are experts in Amazon selling and advertising. In other words, you can rest assured that your business will be making significant strides in international markets in their hands.

FAQ – Frequently Asked Questions

Who Are Amazon Aggregators?

Firms acquiring successful Amazon FBA brands have attracted over $15 billion in capital. Overall, there are more than 80 active Amazon seller aggregators worldwide, with the number expected to grow in the following months.

Most aggregators are based in North America. However, there are also companies operating in Europe, Canada, China, India, South Korea, Japan, Mexico, Singapore, Spain, and the UAE.

What Is an Example of an Aggregator?

FBA aggregators focusing on North American registered businesses include Link Ventures Foundry Brands, Architech Capital Intrinsic Brands, Forum Brands, Cap Hill Brands, Goldman Sachs Asset Management, Softbank Cap Hill Brands, RBC Capital Markets, and Tiger Global Management.

Some of the top Amazon aggregators in Europe buying european amazon brands include Razor Group, Equity Investors Kingsway Capital, Equity Investors Venture Friends, and Berlin Brands Group.

What Challenges Do Aggregators Face?

The biggest challenge that FBA aggregators face is market oversaturation. That’s why they are also selective when choosing amazon ecommerce brands.

Bottom Line

Acquiring Amazon FBA brands is a thriving industry right now, which is why Amazon aggregators are looking for successful ecommerce brands to purchase.

If you are considering selling your Amazon business, take time to research and identify aggregators that suit your brand. It’s essential that you meet the criteria discussed above. You should also produce the necessary reports and documents to prepare for their acquisition efforts.

But most importantly, you need to be dedicated to growing your business to one aggregators can trust.

To help you get started, I’ve compiled a list of the best Amazon seller tools. We also have a ton of other resources to help you be a more effective seller, so feel free to visit our blog.