What Are the 10 Best Payroll Software for Small Business Vendors?

Here are my top picks for the best payroll service for small business vendors.

The best payroll software for small business vendors automates one of the most taxing parts of running a company: paying employees.

The advantage of payroll software stretches past regular payroll services and even helps with tax filing.

If you’re looking for the best payroll company for small business vendors, my list can help you.

I have ranked and reviewed the best small business payroll software to help you make the right choice. Here are my top five picks at a glance:

Here are my top picks for the best payroll service for small business vendors.

Omar's Take

Gusto is a small business payroll software perfect for solopreneurs to larger organizations. It blends different payroll services and HR responsibilities to create an all-in-one tool.

Gusto is an all-in-one solution for small and big companies.

This tool has features to help with payroll, benefits management, and employee hiring. Its prices are very straightforward and don’t push upsells.

This payroll software reduces errors through automation and is very user-friendly to beginners. It also offers review templates to help you gather data to improve your business further.

Here are Gusto’s features.

W-2 And 1099 Filings

Gusto handles your payroll taxes by automating W-2 and 1099 forms instead of manually asking your employees to fill them out, check the information, and store it somewhere. The payroll software stores and ensures your business complies with payroll tax filing.

Hiring And Onboarding Tools

Small business payroll software should have hiring and onboarding tools for faster turnaround. Gusto offers e-signed documents, letter templates, and a checklist to easily facilitate onboarding.

Custom Admin Permissions

Gusto lets you customize other business tasks that need automation. It can set new parameters for actions requiring approval.

Instead of going back and forth with your employees, your payroll software handles requests, queries, and permissions for custom measures. You can also choose how to automate the steps and add or subtract the approval process.

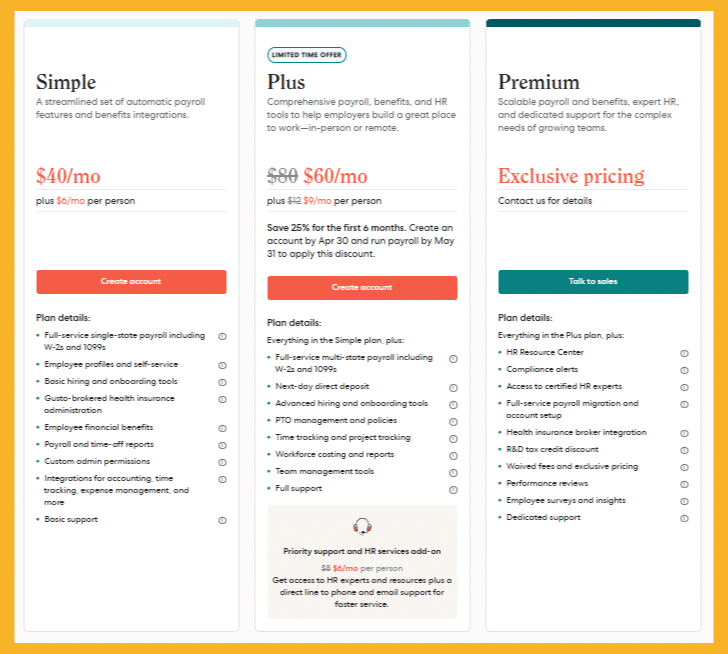

Gusto isn’t the cheapest small business payroll software on the list. If you are starting and need a more budget-friendly solution, this payroll service may not be ideal.

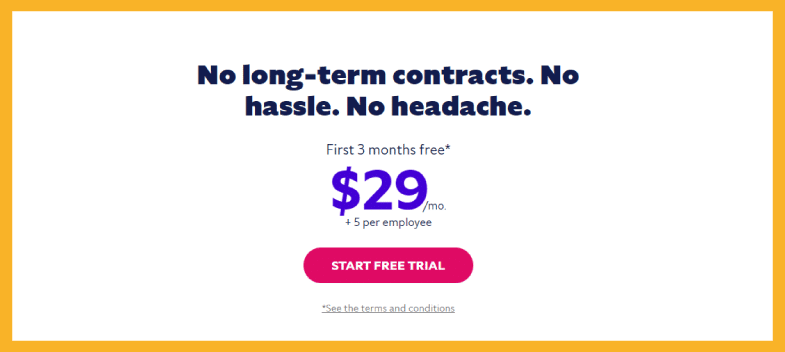

It costs at least $40 monthly And another $6 monthly per user.

If your business revolves around fast turnarounds and is a blend of contractual and permanent staff, this will cause complications in your pricing.

You can find other solutions with more flexible payroll services.

Here are Gusto’s pricing plans.

Omar's Take

QuickBooks Payroll is the ultimate standard for good accounting. If you already use QuickBooks accounting, adding the small business payroll software integration maximizes your accounting, payroll, and HR capabilities.

QuickBooks Payroll services are perfect if you already use QuickBooks for your other accounting needs. This payroll software automates your payroll process with features like its next-day direct deposit while helping you with payroll tax filing.

The small business payroll software promotes 100% accurate tax filing calculations while letting you track time, benefits, and compensations. You can synchronize everything with your accounting to avoid doing payroll tax filing separately.

Here are QuickBooks Payroll’s features.

Tax Penalty Protection

QuickBooks Payroll is one of the best payroll software because it guarantees up to $25,000 for penalties your business occurs. The payroll software handles payroll tax misfilings, delays, or wrong amounts.

HR Advisor Access

If your business is still new, this small business payroll software offers HR advisor support to help you achieve the best payroll system. This small business payroll software lets you integrate the best practices between your payroll and accounting.

Affordable Health Benefits

The QuickBooks Payroll service offers packages with SimplyInsured, giving you access to affordable health insurance. Small business owners won’t need to worry about purchasing insurance separately as everything is accessible under the payroll software.

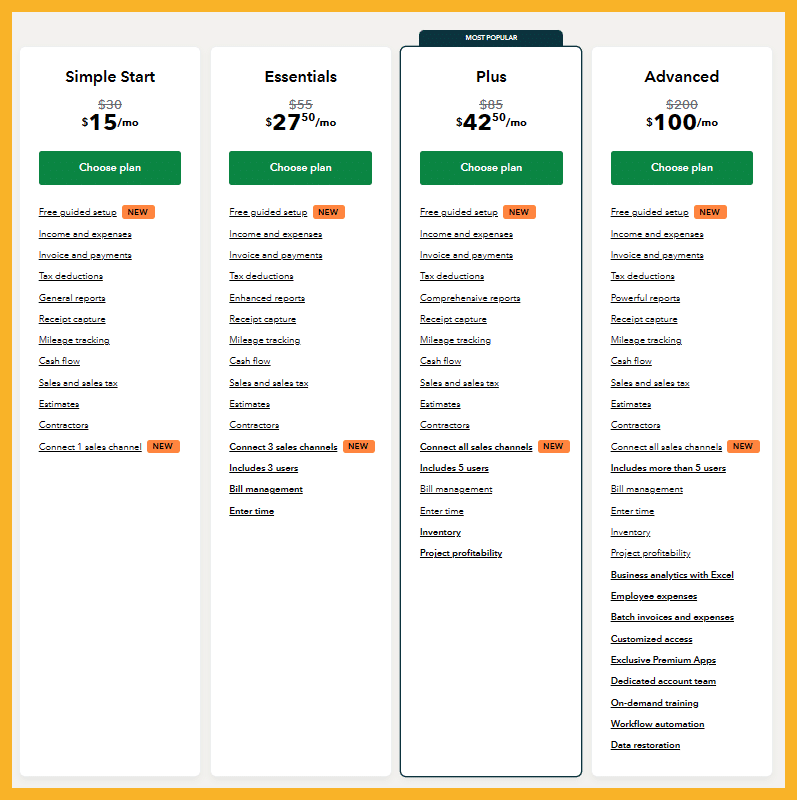

With the QuickBooks Payroll service, you must subscribe to a plan before adding payroll capabilities. An additional employee also costs $5 monthly without tax.

QuickBooks doesn’t let you access its payroll software unless you subscribe to its basic plans. Its payroll service is also more expensive than its basic plans.

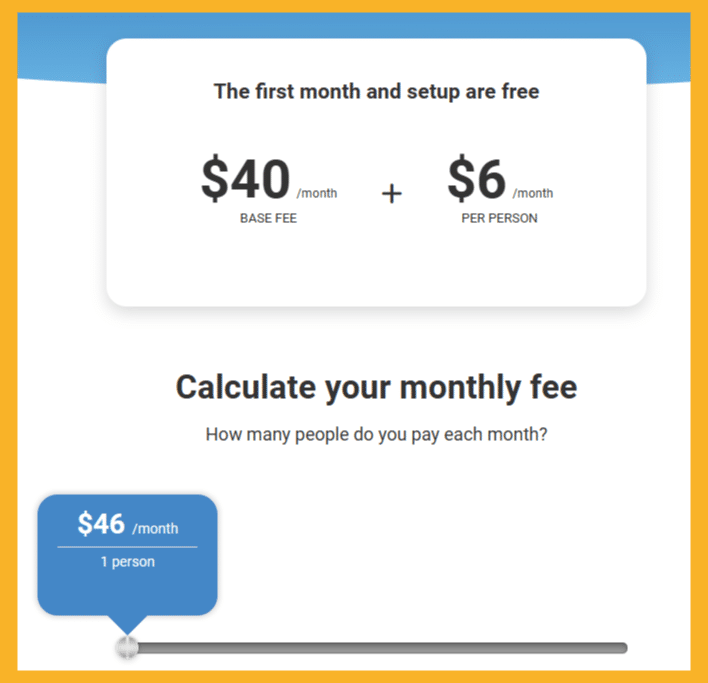

Here are QuickBooks Payroll’s pricing plans.

Omar's Take

Paychex is best for solo entrepreneurs who want to scale their businesses. This payroll software lets small business owners start small and grow their payroll systems without sacrificing compliance.

Unlike other small business payroll software, Paychex is less intimidating and offers full-service payroll that expands along with your business. Most payroll software for small businesses caters to companies with a more significant headcount.

This solution offers one payroll program for small business owners to handle HR, payroll, and benefits. It also automates payroll taxes and other compliances to avoid delays, penalties, and misfilings.

Here are Paychex’s features.

Employee And Employer Mobile App

This small business payroll software offers a mobile app for employees and employers. There’s an employee self-service portal to help automate requests and HR practices without taking your time.

Analytics And Reporting

Paychex lets you see the analytics and reporting for the entire payroll process, including how you pay employees. You can check the performance of your payroll systems and find ways to improve them according to your data.

HR Documents Library

Instead of multiple databases, this small business payroll software lets you access critical HR documents in one interface. The payroll service gives you a repository where you can store important documents safely and efficiently.

One of the drawbacks of Paychex is that it is too customizable. Because of its scalability, its price changes as you scale your business.

Its custom plans are also confusing for beginners since most small new entrepreneurs often don’t know which features they need.

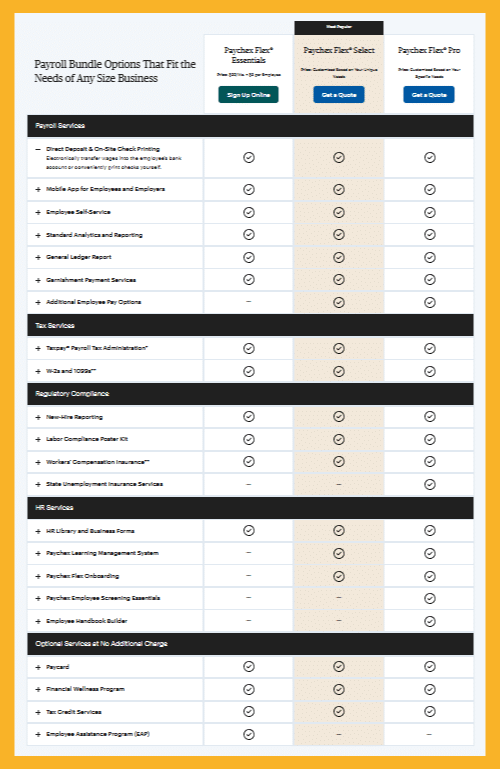

Here are Paychex’s pricing plans.

Omar's Take

This is the best payroll solution for businesses that need cheap payroll software for small business systems. Patriot Software offers full-service payroll capabilities, including tax filing software for small businesses on a budget.

Patriot Software is the best payroll solution for businesses on a budget. It has a Basic and Full-Service Payroll option if you want other sophisticated tax filing features.

The payroll software will process payroll for as low as $4 per employee, compared to the $5 or $6 other businesses charge.

The Patriot Software for small businesses also offers a 60-day money-back guarantee if you don't like the payroll software.

It’s the best payroll for businesses on a budget is it doesn’t require a long-term contract—you can quit anytime.

Here are Patriot Software’s features.

Free Expert Support

Patriot offers the best payroll expert support in the US, with customer support lines open from 9 a.m. to 7 p.m., Mondays to Fridays. Its technical staff has the skills to handle simple and critical issues.

Pay Frequency Options

This payment software allows you to send payments on various frequency options. You can choose from daily, weekly, bi-weekly, monthly, or other arranged payment frequency terms.

Independent Contractor Payments

Paying contractors won’t cause complications in your payroll software database. You can process payroll for one-time and long-term contractors without disrupting your payroll system.

Patriot’s premium features, like tax filing, require a subscription to the more expensive full-service payroll plan. The plan costs $37 monthly, close to other payroll software for small businesses.

The payroll software doesn’t have next-day direct deposit. Instead, it offers two-day direct deposits for qualifying customers. The two-day wait can cause problems for businesses needing instant direct-deposit solutions.

Here are Patriot Software’s pricing plans.

Omar's Take

Homebase is the best payroll software solution for businesses with hourly staff. It has additional flexibility to help pay employees working on complex or flexible schedules.

Unlike other payroll providers, Homebase has more flexible payroll systems to help you manage work schedules, hourly wages, and other confusing HR support- activities.

Instead of spreadsheets, the payroll software simplifies the user interface for employees and employers.

The payroll software has its unique team communications tool to avoid using other software.

Aside from handling employee payments, workers can directly contact HR support through the app to file leaves, change schedules, or ask other payroll system questions.

Here are Homebase’s features.

Performance Tracker

You can track your employee’s performance through the payroll system. Doing so makes evaluating your workers’ compensation and spotting underperforming staff easier.

Applicant Screeners

The payroll system automatically filters applicants through screener questions. These HR features let you maximize your HR resources by only interviewing applicants that pass the initial screening.

Employee Roster:

If you have hourly workers, tracking their roles and responsibilities can be challenging. The payroll system gives descriptions, roles, and responsibilities per employee within the payroll solution.

Homebase’s features differ from other payment solutions because it focuses on hourly workers. Although you can handle regular staff, the interface can handle more complicated scheduling.

E-signing employee paperwork (ex., W-5, W-9, I-9, etc.) is only available for Homebase’s most expensive monthly plan of $80.

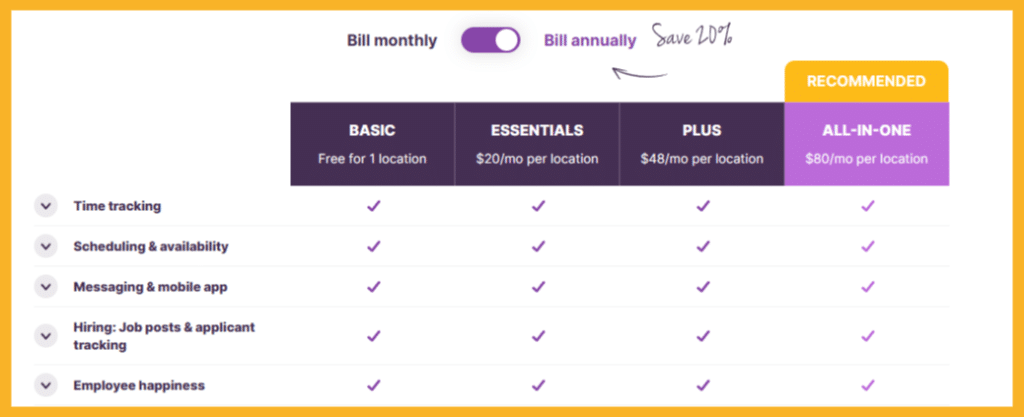

Here are Homebase’s pricing plans.

Omar's Take

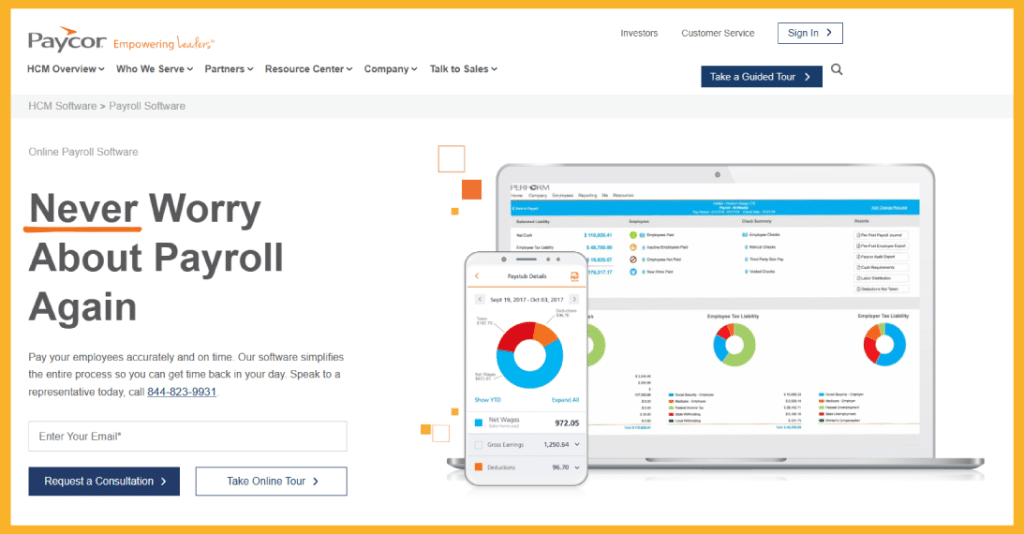

Paycor is a payroll software solution with comprehensive HR tools. As one of the best payroll software, it enables your human resource department by offering HR capabilities.

This payroll and HR solution enables automatic tax filing with other accounting software capabilities. Paycor lets you easily comply with federal and state taxes, health insurance, employee benefits, and other HR services.

The HR tool also offers unique visuals for business owners to view their wages, workers’ compensation, and other expenses. Unlike other payroll providers, Paycor has accounting software integration, making payroll and HR accessible in one interface.

Here are Paycor’s features.

Reporting Dashboard

Paycor’s dashboard lets you view your small business’s cash requirements, tax liability, and payroll reports. Monitor expenses with visuals of how much you’re spending and where your money goes.

Compliance Expertise

The payroll and HR tool is experienced in compliance regardless of your state or industry. Compliance feedback, queries, and requirements are all handled in-app to avoid overlapping information and complication of databases.

Expert Tax Compliance Support

Paycor offers expert tax compliance support for small businesses that struggle with employee onboarding and handling tax forms. It includes legal assistance for workers’ compensation insurance and other matters when filing taxes.

Unlike other payroll providers, Paycor is more complicated because of its integration with HR. Because it offers more than just payroll processing, its other HR features might not be helpful for smaller businesses.

Paycor is also not the best payroll provider for handling contractors and consultants. It also doesn’t have good customer support. Unless you’re familiar with payroll solutions, you’ll struggle to adjust to Paycor.

Paycor’s pricing plans depend on your company's needs. Request a consultation to get a quote on how much you should pay.

Omar's Take

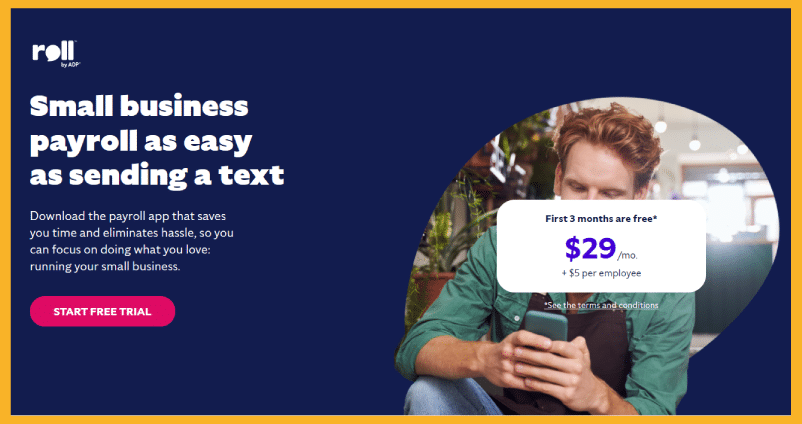

Roll by ADP is the best payroll software for companies relying on mobile solutions. This payroll provider is the best mobile solution, making payroll “as easy as sending a text,” according to the website.

Roll by ADP is a straightforward solution for businesses needing a mobile and simple payroll processing solution. The payroll provider makes the tool as friendly as possible for mobile users.

The payroll provider also adapts to your small business, giving compliance notifications and alerts to ensure your business stays up to date with requirements.

Roll by ADP is effortless because you only download the tool, chat, and pay.

Here are Roll by ADP’s features.

Payroll Tax Administration

This basic payroll solution gives you a chat-based approach to handling federal, state, and local taxes in all 50 states.

This payroll service provider makes sure small businesses comply with filing taxes no matter where the business or the employees are.

Employee Easy Access

Most payroll providers offer portals per employee where they can access their health insurance, bonuses, overtime, and payment info. Roll by ADP is the best payroll software for staff to access employee benefits on their phone.

Easy Bonuses

Incentivize your staff through employee benefits and bonuses, which you can employ in just a few clicks. The payroll processing solution lets you give raises and bonuses without complicating how you file payroll taxes.

The problem with Roll by ADP is that it lacks software integration, potentially affecting your accounting software. If you need flexible payroll software solutions that are more flexible, this payroll processing solution isn’t the best choice.

Users of Roll by ADP report that the basic payroll solution doesn’t have call support.

You might end up waiting for a long time, which is often detrimental to small businesses when there is a serious issue.

Roll by ADP only has one plan that costs $29 monthly and $5 per additional employee.

Omar's Take

OnPay is the best payroll processing solution for small businesses that have never tried payroll processing. This affordable payroll system caters to first-time small business owners that don’t know how to run payroll and struggle with their accounting software.

OnPay incorporates a payroll tax administration approach that helps small businesses run payroll under their HR department.

It also offers specific HR features for restaurants, doctors, gyms, nonprofits, and other industries.

The service includes the basics like automated tax filing and other payroll tax compliances but with additional HR features like reviews and stats per employee. These features help small businesses monitor employee benefits and performance.

Here are OnPay’s features.

Payroll Integration

OnPay simplifies running payroll with other accounting tools. It supports integration with software like QuickBooks, Xero, and other timekeeping software and productivity tools.

Expert Support

Small businesses can contact OnPay for any payroll tax administration questions and other queries on how to run the software. It also includes resources and advice on giving employee benefits and complying with payroll taxes.

Industry-specific Features

OnPay is for any professional employer organization, regardless of industry. The online payroll service specifically supports ten sectors, where you can niche down and adjust your software to fit your specific needs.

OnPay lacks customization options for emails sent to your team when processing payroll, even for off-cycle payments.

When running payroll, employees get a standard email. HR must send a separate email if they have other questions or queries.

OnPay also lacks premium consulting features, and live phone support is unavailable during weekends. If you have technical problems, this solution’s support team might not be the best to handle your queries or issues.

The base fee is $40 monthly and $6 monthly per person.

Omar's Take

Justworks is the best to handle remote teams with outsourcing payroll solutions to multi-state payroll compliance procedures. It’s a professional employee organization (PEO) with an upper edge for remote small businesses.

Justworks has HR tools to help small businesses process payments, payroll tax compliance, and portals per employee. The flexible PEO plan has a premium version where small businesses can access dental, medical, and health benefits.

This solution is for any small business with high turnover and complex international hiring practices. Its HR tools help you onboard, manage, and facilitate payments and payroll tax.

Here are Justworks’ features.

Fast Onboarding Solutions

Justworks offers fast onboarding solutions, where a small business can add new hires in minutes. There’s also a self-service employee portal for staff to review company policies and troubleshoots.

Payday Breakdowns

The small business offers a breakdown per employee, showing taxes and deductions or employee benefits added. Employees get automatic notifications for their pay stubs, and employers get reports on automatic tax payments.

Work Hours Tracker

Aside from contractor payments, you can geo-track the logged hours per employee with overtime alerts and shift scheduling. You can also integrate payroll into your timesheets to monitor employee input and payment output.

Justworks is very expensive.

You need to spend $59 monthly per employee, meaning a group of 10 employees will cost $590 monthly.

You can only access Justworks’ medical and dental solutions with its more expensive $99 monthly Plus plan. The solution also lacks professional technical support, with customer service reps that may not be familiar with your issues.

Here are Justworks’ pricing plans.

Omar's Take

Wave Payroll is best for businesses that mostly employ part-timers and contractors. The solution is for a flexible small business structure with few permanent employees.

Wave Payroll offers two options for your small business: 1) self-service states and 2) tax-service states.

Here are tax-service states:

All other states are self-service states, which cost half the price of tax-service states. Automated tax filing is only available for tax-service states.

Here are Wave Payroll’s features.

One-click Direct Deposit

Wave Payroll makes directly depositing your employee’s accounts easy. Its interface lets you send a direct deposit with a single click.

Worker Compensation Protection

You can offer your small business worker compensation and employee benefits without overpaying. Wave Payroll lets you pay only for the benefits you use and save the difference on unused benefits while simplifying your annual audits.

Wave Advisor Assistance

Wave Payroll enables you to access Wave Advisor to help with small business filings and compliances. It also assists you with your personal income tax.

Wave Payroll’s automatic tax filing is only available for limited states. The software is also not customizable, and some payroll features won’t fit your business system.

There are only three designs to choose from, limiting the customization, simplification, and optimization of the invoice-sending process. It’s also slow to load if you don’t have a good internet connection.

Here are Wave Payroll’s pricing plans.

Payroll software is a productivity tool to help you improve your business by maximizing your operations.

Here are the benefits of the best payroll software for small businesses.

Payroll software helps you accurately calculate taxes for your companies and employees, saving time and protecting you against the risk of misfilings.

Some tools offer personal income tax to help business owners, solopreneurs, or sole proprietors who earn income from their businesses.

Payroll solutions like Justworks can give you a breakdown of employee payments, including deductions, bonuses, tips, and other compliance requirements.

Since everything runs electronically, this drastically decreases the risk of mistakes in tax filings and employee payment breakdowns.

The advantage of payroll systems is they drastically reduce turnaround times and streamline processes to ensure minimal to no delays and proper compliance.

Accounting and HR integration helps remove the additional steps needed to pull information from one tool to another. For example, QuickBooks Payroll can integrate with other accounting and HR tools.

Payroll software keeps surface-level employee documents and stores essential tax-filing documents like W-2 or 1099 forms.

Tools like Patriot Software give you access to part-time and contractor forms for tax and compliance filing. The software stores everything in a secure database which is all compiled later on for automated tax filing.

Automation streamlines the process and decreases the number of people accessing your company’s payroll data. This feature helps protect you and your employees against fraud and other financial threats.

Only a few people can access your files and forms with payroll software. Despite automation, the software can also require approval from you or your trusted staff before sending out any form or file.

The local, state, and federal laws can be confusing. Payroll software with integrated automatic tax filing features helps you comply with tax laws.

Some providers even offer guarantees to businesses that use their services to compensate for mishandled compliance. QuickBooks, for example, offers up to $25,000 on any penalties your business occurs under their service.

Instead of requesting periodic reports on employee payments, performance, and other aspects of your business, you can view everything through one platform.

You can also view employee rules and responsibilities, making identifying staff roles in larger organizations easier. Homebase, for example, has an employee roster where you can view each employee and their description.

Handling a few employees on payroll is easy, but tracking them gets more challenging as your organization grows.

Some payroll tools scale with your company, making adding new employees, contractors, or part-timers to your payroll easier.

Solutions like Wave Payroll make adding part-timers or contractors to your payroll easy, with the necessary forms and files in place. This feature makes managing your hybrid organization more manageable.

Here are some factors you must consider when looking for the right payroll software for your business.

User interface or user experience (UI/UX) refers to the user-friendliness and appeal of the software.

It may not be the ideal tool if you have trouble using or incorporating the software into your system.

High-quality payroll software should be intuitive and reliable while offering understandable graphics and proper tool design for better use.

Consider whether the payroll software gives accurate information. Some tools include built-in accuracy checks to ensure everything is understandable and reduce the risk of errors.

Although human errors are difficult to avoid, payroll software helps minimize misfilings by offering accurate files and forms for compliance measures. Automation helps decrease the amount of human error.

If you are a small business with more minor needs, look for payroll software that fits your budget.

Since most payroll software charges per employee, $1 makes a big difference. If you have 100 employees, a $5 subscription will help you save $100 compared to a $6 subscription.

There is payroll software built for scalability, like Paychex, where your payments gradually increase as your business grows.

Scalability is vital for companies with high turnarounds and fast onboarding procedures.

The ideal payroll software should also help with the employee onboarding process. Homebase, for example, has applicant screeners that help you narrow down applicants and focus HR resources on ideal candidates.

Does your software integrate with other tools?

If you use other software for accounting or HR purposes, your payroll tool must integrate with them.

For example, QuickBooks lets you do everything in one place. It saves you time, effort, and resources by eliminating the need for two separate databases.

When looking for the right payroll software, ensure they have adequate customer support. Try reaching software providers through their channels and asking simple and complex questions.

Some solutions fail to offer consistent customer support once you are a subscriber. You can read user reviews on how badly a company replies to queries or issues.

You need to determine your business needs to get the best payroll systems.

Grade the significance of these factors according to your unique business needs.

QuickBooks Payroll is one of the best payroll accounting software because of its integration with QuickBooks accounting software.

Gusto, QuickBooks Payroll, Paychex, Patriot Software, and Homebase Payroll are among the best payroll software for small business vendors.

I hope my list of the best payroll software for small businesses helps you choose the ideal one for your needs.

Don’t hesitate to experiment with free trials to determine the most suitable solution.

If your business deals with a significant amount of data, it may help to learn more about the best data visualization tools.

© 2023 All Rights Reserved by OJ Digital Solutions

Do you need help with anything in particular? Fill out this form and we'll get back to you.