What type of transactions needs a money order?

If you’re looking for info on CVS money order transactions, you’ve come to the right place. I’ll explain why money orders are excellent for your business and when you should use it.

I’ll also discuss making a CVS money order transaction at a bank or credit union.

Let’s start.

What Is CVS?

CVS is a retail corporation known in the pharmaceutical and health sectors. Aside from offering medicine, they also offer money order services for their clients.

You can purchase money orders and cash out money orders with CVS.

The CVS pharmacy has over 10,000 locations, with 1,700 pharmacies inside Target and Schnucks grocery stores.

Why does CVS sell money orders? The company’s many locations make it convenient to transfer money orders.

CVS sells money orders because it is profitable. They charge $1.25 (the rate may differ) every time you buy a money order.

You must buy many money orders if you reach the maximum amount at the CVS stores.

Although you can buy CVS money orders, you cannot cash money orders at CVS stores.

What Is a Money Order?

A money order is an issued certificate that has a cash equivalent. Instead of a money transfer, you can buy or sell money orders without revealing your bank account.

This transaction lets you do money transfers without a bank or credit union involved, ensuring the money transfers don’t go through scrutiny.

If you want to send a money order past the maximum amount, you can buy multiple money orders and send them to make one huge transaction.

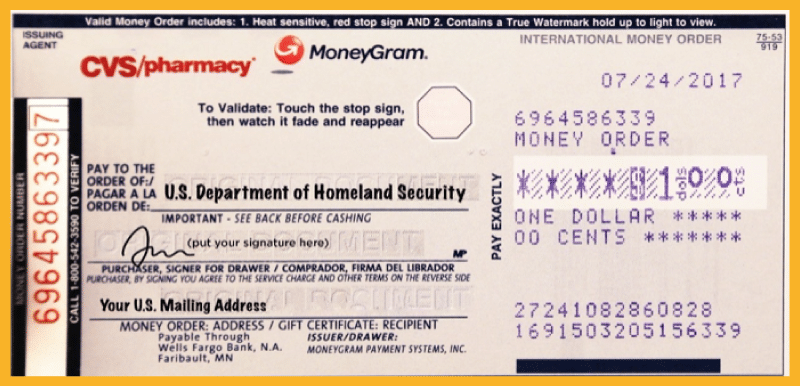

Some locations charge more than others for purchasing money orders or when you cash money orders. MoneyGram’s automated line enables these money orders.

MoneyGram money orders are expensive if you need to purchase hundreds to thousands at a time.

What Is a CVS Money Order?

It’s a money order transaction you can do with CVS. Pharmacies like CVS sell money orders, making sending money around for specific transactions easy.

Here’s a more in-depth explanation of a CVS money order.

How Does a CVS Money Order Work?

When you buy money orders, you need to purchase and claim them.

We’ll explain the different processes between the two.

How Do I Buy a Money Order at CVS?

Here’s how to buy a money order at CVS.

1 – Decide how many money orders you want to purchase.

2 – Go to the checkout register or CVS service desk and tell them that you want to create a new debit account (or debit card account).

3 – Fill in the details and make sure to verify them.

4 – Place your desired money orders in your cart.

5 – Purchase the money orders and keep the receipt with a four-digit pin.

6 – Wait for at least five minutes before you make additional money order purchases.

Most CVS stores sell money orders, but sometimes this feature is offline. You can ask the CVS stores beforehand if they can process money orders.

You can only buy a money order at CVS’s local stores, not the CVS website.

How Do I Claim a Money Order?

Does CVS cash money orders? No.

However, several ways to claim a money order exist, like a bank or credit union.

Here are ways to cash your money order.

Banks

1 – Don’t sign your money order yet.

2 – Go to your bank.

3 – Tell them you want to cash a money order.

4 – Show the teller the money order.

5 – Give them a government-issued photo ID for verification.

6 – Give them your bank account information.

7 – Ask the teller if you can now sign the money order in front of them.

8 – Receive the money in exchange for the money order or deposit it directly in your debit card or checking account.

Note: Some banks will charge you for cashing money orders.

Post Offices

Cashing money orders at the post office is free, unlike a bank or credit union.

1 – Don’t sign your money order.

2 – Bring your money order to the local post office.

3 – Tell the cashier you want to cash a money order.

4 – Present a photo ID and let them inspect your money orders.

5 – Give them your debit cards or checking account (You don’t need a bank account if you choose cash.).

6 – Wait for the teller to tell you to sign the back or ask them if you can.

7 – Receive the money in your account or cash.

Walmart Stores

The Walmart retail store is best for cashing MoneyGram money orders, especially if you need it for shopping.

1 – Visit your local Walmart grocery stores.

2 – Look for the customer service desk or Money Service center.

3 – Approach the teller and make sure your money order is not yet signed.

4 – Show them a government-issued ID along with your money orders.

5 – Give them your banking details or tell them you want to receive money in cash.

6 – Sign the back of the money order in front of the teller after verification.

7 – Wait for the notification that your bank has received the money transfer, or get cash if you decide to cash out.

Walmart charges additional fees if you want to convert your money order.

Advantages of a Money Order

There are many advantages of using money orders instead of cash or cards for transactions.

Here are the top reasons you should use money orders.

Convenience

You can buy Western Union money orders. Alternatively, you can get money orders from a CVS store or another financial institution.

A typical money order limit is $1,000. You can do a money order if you don’t want to carry that much cash.

Security

A money order is a safe payment method if you do not trust a vendor enough to give them your bank details.

You can easily buy Western Union money orders or money orders at CVS if you have a transaction you aren’t comfortable paying in cash or giving your banking info.

Affordability

A money order is an affordable way to pay someone or transfer money. Some credit unions charge a lot if you want to send money.

Western Union, for example, can charge you $35 if you pay in-store. Your local CVS will only charge you $1.25 (depending on location) for a money order.

Transparency

When you buy money orders at CVS or other financial institutions, you can track it and see the recipient’s information when the recipient cashes it.

You can also see the local store used to cash out the money order. If you lose a money order, you can ask for a replacement as long as you have the details.

Ability To Handle Large Transactions

You can purchase a money order for large transactions. Your nearest CVS store has a maximum dollar amount of $500 for your money order.

Other payment services or convenience stores selling MoneyGram money orders have a $1000 price limit but might charge more. Many CVS stores charge a small fee of $1.25 for your money orders.

Identity Protection

You can purchase a money order to make a transaction without revealing your personal information allowing you to keep your anonymity.

You can carry a MoneyGram money order to have money ready for transactions if you don’t trust the other party.

Tax-friendly

You can purchase a money order to pay for bills or transactions to avoid a record of the transaction.

If you use a credit or debit card, your records will only show when you buy money orders and not where you spend them.

Cancelation Option

You can cancel the transaction if you lose your certificate. Go to where you bought the money order and ask the store to change the recipient information.

You will need to prove you own the money order, so it’s vital to save the details just in case you lose them.

International Transaction

You can use a money order for an international payment. You can send a money order if you need to pay for something overseas without a bank account.

You can also cash money orders internationally instead of bringing physical money when traveling.

Disadvantages of a Money Order

Like other payment methods, there are clear disadvantages when using money orders.

Here they are.

Limited Payment Options

Most money order vendors only accept cash, debit, or credit. Finding a vendor that takes PayPal can be challenging if you use this payment method.

For other services like PayPal, you need to transfer the money to your bank before you can purchase a money order.

Expensive

Depending on the size of the transaction, paying with a money order might result in you spending more.

If you’re placing a $200,000 downpayment on an expensive house and want to use CVS money orders, you’ll need 400 orders to get $200,000.

If the store charges you $1.25 for each order, you will spend $500 for the transactions. It might be cheaper to issue a check for large transactions.

Hard To Track

If you frequently use a money order to pay for things, you will find it hard to track your transactions.

The difficulty in tracking money orders can cause a problem if you want to track your expenses and know where you spend your money.

Holding Funds

Some issuers will hold your funds for one to five days before you can cash the money order. There are also cases when an error occurs, and the issuer does not clear your money order past this timeline.

If your money order does not clear in five days, you should contact the issuer to raise the problem. CVS issues your orders instantly.

Possibility of Counterfeit

Bad actors can counterfeit a money order. Although this is rare, there is still a slight risk of losing your money.

Cases have dropped recently, but you can still report it if someone steals your funds.

Hassle

Sometimes it is easier to just send the funds directly or wire them through your bank instead of going to a vendor, buying a money order, sending the money order certificate, and waiting for the recipient to cash the order.

In certain events, it is easier to choose other modes of payment.

Cancelation Fees

Specific fees apply if you lose your money order and need to ask for a new one. If you often lose your money order, your penalty payments will stack up.

These fees are sometimes higher compared to bank check cancellation fees.

Financial Limits

If you need money orders worth thousands of dollars, you need to purchase multiple orders to fill that order.

Carrying multiple orders increases the risk you bear. Giving your money orders to another individual is even riskier because they need to account for each order.

Not Always Accepted

Not all businesses will process money orders, and it’s rare for conventional stores to accept them.

If the store does not accept your money order, you must cash it to use the money for your purchase.

Slow Delivery

If you send a money order through the mail, it will take some time before the recipient gets it. The waiting time is inconvenient if you have an urgent transaction and need to pay immediately.

You need to go to a store, bank, or vendor that lets you cash your orders. You must confirm with the business that they cash orders before going to their location.

Is There a Cvs Money Order Limit?

A typical CVS limit for money orders is $500. Depending on the location, there might be a minimum amount for a transaction.

If you do not have enough money, you cannot buy a money order at CVS Health (or other CVS locations).

Can You Track Your Money Order?

Yes. If you save the tracking number, you can track where the recipient cashes your money order.

Do CVS Money Orders Expire?

No. Money orders do not have an expiration date. However, depending on the state, you might incur a small fee if you do not cash within a year to three years.

The Bottom Line

I hope you’ve learned what you need to know about CVS money order transactions.

Before buying a CVS money order, try calling the store beforehand to ensure you don’t waste your time.

If you receive SNAP benefits and are looking for alternative payment methods, you might be interested to know that you can use your EBT card at several stores.

For example, did you know that Target accepts EBT?