You don’t need an LLC to sell on Amazon, but it can help protect you and your business.

Amazon runs on a simple model: they want to make it as easy as possible for their customers to do business with them.

So they don’t care about your business structure.

Whether you’re a sole proprietor, a limited liability corporation (LLC), or anything else—you just need to be able to prove that you’re who you say you are and that you have the right to sell the product in question.

If you meet those requirements, then Amazon will take the money made on your amazon sellers account and send it to the product seller (which could be you personally or a registered business).

Your name doesn’t matter—as long as you have permission from the manufacturer or distributor of whatever good or service you’re selling.

However, you can enjoy many benefits if you register as an LLC, and in this article, we’ll go over these.

If you’re ready to know what an LLC is and how it can help you in your Amazon selling journey, hop on!

PS: I’m an Amazon expert, not a legal or tax advisor. Please refer to a legal or tax professional before making any decision.

What Is An LLC?

LLC stands for “limited liability company.” Since it’s a separate legal identity, It shields its owners from personal liability.

This type of organization can be set up in any state. It also comes with tax advantages.

Either one person (single member llc) or multiple people can form LLCs (Partnership).

The owners of an LLC are called members, and they are usually referred to as “members” even though there may only be one member in a small business.

Do You Need An LLC To Sell On Amazon?

Amazon does not require it, but there are a few reasons you might want to do this.

The first reason for forming an LLC is to protect your assets.

Especially if this is a new business, in case it fails, you will want to ensure that any debts or liabilities the business has are limited only to the company itself.

The second reason is so that you can conduct business under a separate entity.

This allows you to keep your business finances from your personal life, which is particularly important if you have other sources of income besides just selling on Amazon.

The third reason for forming an LLC is to limit liability explicitly related to selling products on Amazon (or other online marketplaces).

This is crucial if you sell products online.

If someone gets injured while using your products or if they’re unhappy with their experience, there’s no need for them to sue your personal assets—they can sue the company instead!

Forming an LLC can also be helpful if you need to raise capital in the future or if your business ever goes public.

Many people who sell on Amazon are afraid to set up an LLC because they think it will be too expensive, but that’s not true.

If you’re just starting with Fulfillment by Amazon (FBA), you can get started for free with no legal entity.

But, If you want to start selling more than 40 items per month or have more than one person involved in your business, it’s time to consider setting up an LLC.

LLCs are relatively easy and inexpensive to set up, especially compared with other types of businesses like S-Corps and C-Corps, which require more paperwork and filing fees upfront (though these fees get deducted from your profits).

How To Set Up An LLC For Amazon

As a business owner, it’s essential to understand your legal obligations and responsibilities. You’ll want to ensure that all of your bases are covered in taxes and liability.

Here are ways on how you can set up a limited liability company:

Select Your State/Location

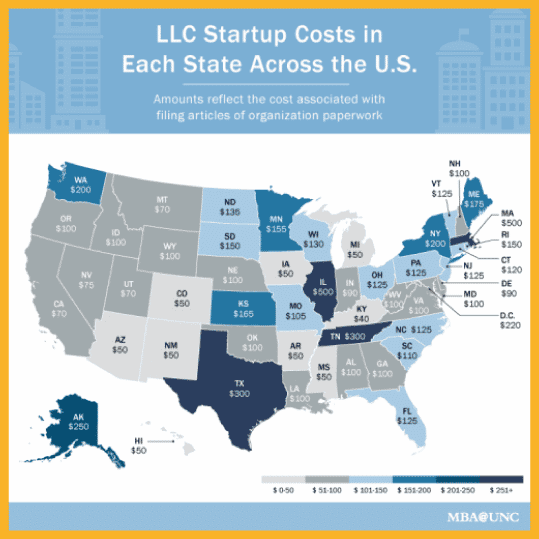

The first step in creating an LLC for Amazon is selecting your state/location.

Many states offer LLCs, and each has its requirements. Some states only require you to submit a few documents, while others require more documentation.

It may be helpful to research the income tax rates for each state you’re considering—this will help you make an informed decision about where your business should be located.

Name Your LLC And Find A Domain

You need to choose a unique business name that makes sense for your business.

This will be the name you use when you file paperwork with the state, so make sure it’s something that people can easily recognize as your company.

If you haven’t already, you’ll also want to set up a domain name for your LLC.

This is the website address people will use to find your business online—for example, test-company.com or test-business.org would be examples of domains.

You can buy one from a site like GoDaddy or Namecheap.

Registered Agent

To register an LLC with the state, you must have a registered agent.

This person is required by law to accept service of process on behalf of your LLC.

The registered agent can be an individual, a domestic business entity, or a foreign entity authorized to do business in your state.

When choosing a registered agent, consider the following:

- Does he have experience as an agent?

- Will he act only as an agent for this LLC?

- Does he have a physical address in your state?

If you choose someone who does not live in your state, you may need to make sure they have a physical address where they will accept these documents.

Operating Agreement

An LLC operating agreement is a document that outlines how you want your LLC to operate.

It can include the structure of the company, how revenue will be distributed, and how many votes each member has.

Before starting your Amazon business, the LLC’s operating agreement ensures everyone knows what they’re getting into and their rights as members of the LLC.

You don’t need to hire a lawyer or pay for legal assistance to create one—it’s much easier than you might think!

You just need to ensure it covers all relevant topics and includes all necessary information.

There are two main ways to create an operating agreement: by yourself or with the help of professionals.

To do it yourself, you’ll want to use a template and fill in all relevant information, including who owns shares and how they will be distributed (if at all).

If you choose this option, make sure there are no mistakes or missing information!

The other option is hiring an attorney or law firm to help write up your operating agreement.

This option is usually more expensive than doing it yourself but will ensure everything is spelled out clearly and accurately, so there are no errors.

Filing With The Secretary Of State

Before you can open a business bank account or hire employees and other contractors, this will be required.

To file with the Secretary of State, you need to fill out a form called Articles of Organization (or Certificate of Formation) and submit it with a $50 filing fee.

The form will ask for basic information about your business, including:

- The name of your LLC. This should be as short as possible and should not include any punctuation marks (like commas), as well as no spaces between words.

- Your LLC’s address must match your physical location (not just a PO Box).

- The purpose of your LLC—for example, if it’s for real estate development, then this would be “development” or “construction,” etc.

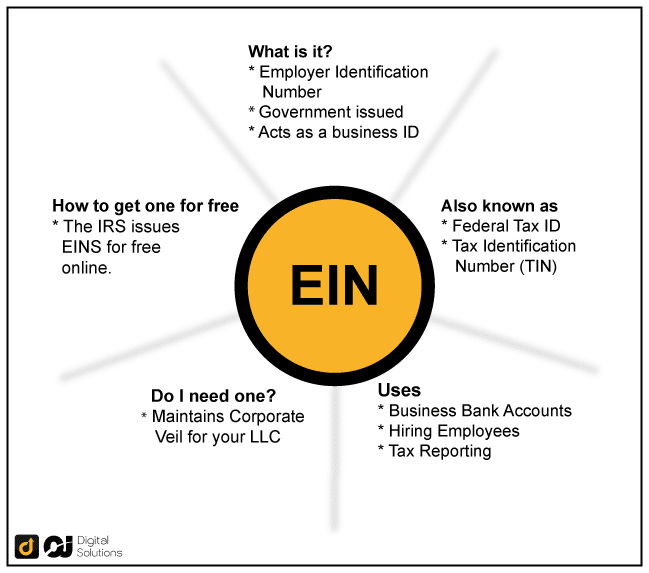

Get An EIN

You’ll need an Employer Identification Number or EIN to set up an LLC for Amazon.

The EIN is a 9-digit number used by the IRS to identify your business.

You can request one online and send it to your email inbox. Once you have an EIN, you can start operating through your LLC!

How Much Does It Cost To Set Up An LLC For Amazon FBA?

The answer depends on several factors.

The first thing you should consider is whether or not you need any type of licensing or permits from the state or federal government.

Some states require businesses to register with them and pay fees, while others do not.

In addition, some businesses may need additional licenses depending on what they plan on selling.

For example, if you plan on selling foods or medical devices, those products will have different regulations.

Other factors affect the cost of starting an LLC, such as: How many people own shares in the company (known as members), how much money each person contributes (known as capital), where it will be located, and whether or not there is any existing debt associated with the company.

All these things can affect how much it will cost to start an LLC.

Benefits Of Having An LLC

You may want to form an LLC if you’re a small business owner, entrepreneur, contractor, or freelancer.

But what are some benefits?

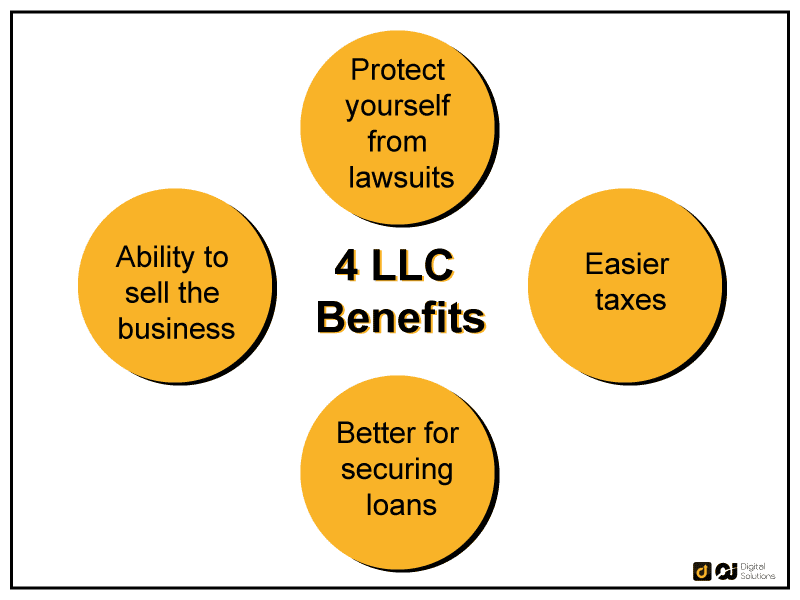

Protect yourself from lawsuits

One of the essential benefits of having an LLC is that it protects you from personal lawsuits.

Think of it as a separate legal entity from you.

It has its own bank account, name, assets, and tax filing rules.

This means that if your business has debt problems or gets sued, creditors won’t be able to go after your personal bank account or other assets to pay those debts off.

Your personal finances and assets are shielded but not your business assets.

Additionally, if another person or entity sues your company, they will generally have to sue the corporation and its shareholders individually.

This may make them think twice before pursuing legal action against a small business owner with limited resources available to pay out any damages awarded in court (or even just attorneys’ fees).

Another benefit I found through research was it helps protect investors if something goes wrong with their investment (or if they need to sell their shares).

Investors should always look closely at what kind of protections are provided by each type/size/genre of investment vehicle before committing money to one; this could mean saving hundreds or thousands over time, depending upon how much money was put into play at once!

Easier taxes

LLCs are more tax-friendly than the sole proprietorship model and regular corporations.

This is because the LLC is a hybrid entity with the best features of both types of businesses.

A traditional corporation pays taxes at a higher rate than an LLC, and a sole proprietorship has no tax structure at all.

Taxes are easy to file in an LLC because they are treated as an entity separate from their owners. So no wonder why most LLC owners open their own LLC for tax purposes.

Plus, you can deduct business expenses, including loans, rent, or other costs, which will make your taxable income much lower than other business structures.

This means that even if your business makes money, you can still pay minimal to no taxes.

Keep in mind that your personal and business expenses are separate. For example, you cannot consider your family vacation expenses as a business expense.

You may also need to pay a franchise tax depending on the state you conduct business and operate from.

Better for securing loans

If you need a loan for your business, it can be beneficial to form an LLC.

An LLC is more likely than other companies to receive a loan because it provides the borrower additional liability protection.

This means that if something goes wrong with your business and you have taken out a loan, your creditors will not be able to go after your personal assets (like houses and cars).

This can help prevent serious financial problems later down the road, which would otherwise make it difficult or impossible for you to get loans.

Additionally, forming an LLC may make getting loans easier even after they’re already secured because lenders will know there’s less risk involved when dealing with someone who owns an LLC rather than another business entity.

As such, this makes them feel safer about lending money out in general—and why wouldn’t they?

It’s much better for everyone involved if there isn’t any doubt about whether or not someone will pay back what they owe!

If everything works out well between the lender and the borrower during these negotiations, both parties benefit from their partnership without worrying about losing anything valuable.

Ability to sell the business

Because the company is a separate entity from you, it can be transferred to another person or entity without consent.

Buyers who want to purchase the business will pay for the company and its assets.

It’s common for an LLC owner who intends to sell their ownership in the corporation for cash.

In addition, because an LLC does not have any real estate or other physical assets outside of its name and intellectual property, selling an entire company could be much easier than selling something like a traditional corporation, where there are additional legal requirements (such as tax laws) that must be taken into account before completing the transaction.

Faq – Frequently Asked Questions

How Is An LLC Taxed?

LLCs are taxed differently than other types of business entities. In some cases, the LLC is taxed as a corporation, but in other cases, it’s taxed as a pass-through entity.

If you’re operating an LLC as a sole proprietorship and are the only company owner, your income will be reported on your sales tax return. If you want to set up an LLC for Amazon FBA and there is more than one person involved in running the business, then you’ll need to file Form 8832 with the IRS to elect whether your LLC should be taxed as a corporation or as a pass-through entity.

If you choose to have your LLC taxed as a pass-through entity, then all taxable income from the business will flow directly from the company to its owners (in this case, those who own shares in the company), who will report that income on their tax returns. This means that all profits from sales made by your Amazon FBA business would be reported as income on each owner’s tax returns.

Pass-through entities do not pay taxes themselves; instead, they pass along their profits or losses directly to their owners, who then pay taxes based on those amounts.

Do You Need A Seller’s Permit To Sell On Amazon?

The short answer is no. But you may need one, depending on the state where you live.

What Is Limited Liability Protection?

Limited liability protection is a form of corporate law that limits the responsibility of shareholders and directors to losses incurred by the company. The idea behind limited liability is that shareholders and directors will have more incentive to invest in a company if they are protected from significant financial loss.

Which Is Better For My Amazon Business — An LLC Or Sole Proprietorship?

Many Amazon sellers choose to set up an LLC or sole proprietorship for their Amazon businesses.

But if you’re still wondering which legal structure is better for your Amazon seller business, here’s some information that may help you decide.

A sole proprietorship is the simplest and most common form of business structure.

You don’t have to file any paperwork or pay fees to start one, but it comes with some risks. For example, if someone sues your company, they can go after all your personal and business property assets.

An LLC is more complicated than a sole proprietorship, but it has more legal protections for you and your business. If someone sues your company, they can only go after the assets owned by the LLC—not anything owned personally by you as an individual.

The main advantage of an LLC over a sole proprietorship is that it provides limited liability protection.

If someone sues your company and wins, they can only go after its assets (that’s why it’s called “limited” liability).

But there are other advantages too: an LLC has tax benefits; it gives more flexibility when setting up contracts between yourself and other parties (like clients), and it provides greater flexibility when setting up agreements between parties.

Bottom line

If you’re selling on Amazon or are in the process of creating your amazon seller account, it’s essential to find an answer to this question: Do you need an LLC to sell on Amazon?

If you’re a small business and want to sell on Amazon without the hassle of registering for an LLC, it may be best to skip this step.

But if your goal is to protect yourself from liability, minimize taxes, and build a profitable Amazon business that you can grow and sell, an LLC may be right for you!