This article discusses in-depth Amazon’s return policy and how it affects sellers of the ecommerce platform.

Selling on Amazon can be fun and fulfilling. However, every once in a while, some customers may be dissatisfied with the product you’re selling and request a return and refund.

In fact, the rates for buyer returns on Amazon can range from around 5% for books, to up to 35% for goods like consumer electronics. This is according to Movley, an enterprise that provides inspection services for e-commerce sellers.

Don’t fret when this happens to your online Amazon business. You can easily deal with this issue in a way that reduces the hassle and keeps your passion for selling alive.

After reading this guide, you’ll learn vital information about the Amazon return policy for sellers, how the policy affects your operations, the types of refunds, and interesting facts about returns on the ecommerce platform and its related services.

Without further ado, let me help you ease the pain of handling Amazon return and refund requests by jumping right in and reading our guide.

Amazon Return Policy

Note: Though I exert every effort to keep our articles fresh, Amazon may update its return policy from time to time. Regularly check either of the two links below to learn about any updates the platform may have added to the said policy.

Third-party sellers, those who are selling their products through the Amazon website, have made the ecommerce platform more diverse and attractive to buyers. Back then, Amazon was in charge of both running the website and finding merchandise to sell online.

The sellers that have contributed to the extensive growth of Amazon’s product offerings fall under two broad categories. Each category of seller has its own refund and product return guidelines.

If you’re a third-party seller on Amazon, or plan on becoming one, read the following subsections of the guide so you can get a simple overview of how product returns work on the ecommerce platform. You will also discover how such returns differ across different seller categories.

Amazon Return Process

Getting a general overview of things first makes anything easier to understand.

In this case, getting a grip on the Amazon seller return policy will be much easier if we know what happens behind the scenes.

So, what goes on after a product is returned either to an Amazon warehouse or a seller’s storage area?

Let’s explore the ways and means by which a returned product makes its way through the Amazon ecosystem.

What Happens When an Item Is Returned To Amazon’s Warehouse?

This section deals with third-party sellers who are subscribed to the Fulfillment by Amazon (FBA) arrangement. Under FBA, Amazon takes charge of customer service and storage of a seller’s product.

A dissatisfied Amazon buyer can generally request a refund for a product he or she ordered, as long as the request is filed within 30 days of receipt of the product. Once Amazon approves the return request, the product is then shipped back to a warehouse owned by Amazon (called a “fulfillment center”).

Once the unwanted product returns to a fulfillment center, Amazon employees check the item and determine whether or not it’s still sellable in the future.

Amazon warehouse staff also determine, based on the resale value of returned items, if sellers are entitled to refunds of both the selling price of products and fees for FBA arrangements. More on this later on in the article.

What Happens to a Returned Item for FBM Sellers?

The process is slightly different for a returned product under the Fulfillment by Merchant (FBM) scheme, an arrangement where a seller is more involved in product storage and customer service.

If you’re one of the many FBM-subscribed third party sellers, returned merchandise goes straight back to you instead of to an Amazon fulfillment center. In particular, the product will be delivered to the return address listed in your seller account. This address could either be that of your home or the storage facility of a third-party logistics company that you contracted.

Also, since an FBM arrangement means you’re not too dependent on Amazon for inventory management, you have more leeway in setting your returns policy because you’re handling your own inventory.

This freedom, however, is not unlimited. It is still subject to some parameters such as the market or country where you’re selling and a few rules laid down by Amazon.

We will tackle the nitty gritty of Amazon’s return policy for FBM in the other sections of this guide.

Now that you have a clearer picture of what happens after a product is returned either to an Amazon warehouse or your storage facility, let’s dive deeper into Amazon’s refunds or returns process.

Amazon Refunds Process

Third-party sellers first become aware of a customer return request on Amazon Seller Central.

However, FBA and FBM sellers see the Seller Central interface a bit differently, as you will find out in the next sections of this guide.

How to Process an FBM Return Request?

The first step in dealing with Fulfillment by Merchant (FBM) return requests is called “authorization.”

When such requests are authorized, it means they have been accepted and the first step towards customer refunds has begun. More on this later on in the article.

If you are an FBM seller, there are two ways on how to change Amazon’s return method: (1) let Amazon do ALL the heavy lifting of authorizing or permitting the processing of return requests, or; (2) tweak the settings to ensure you have some control over all return authorization.

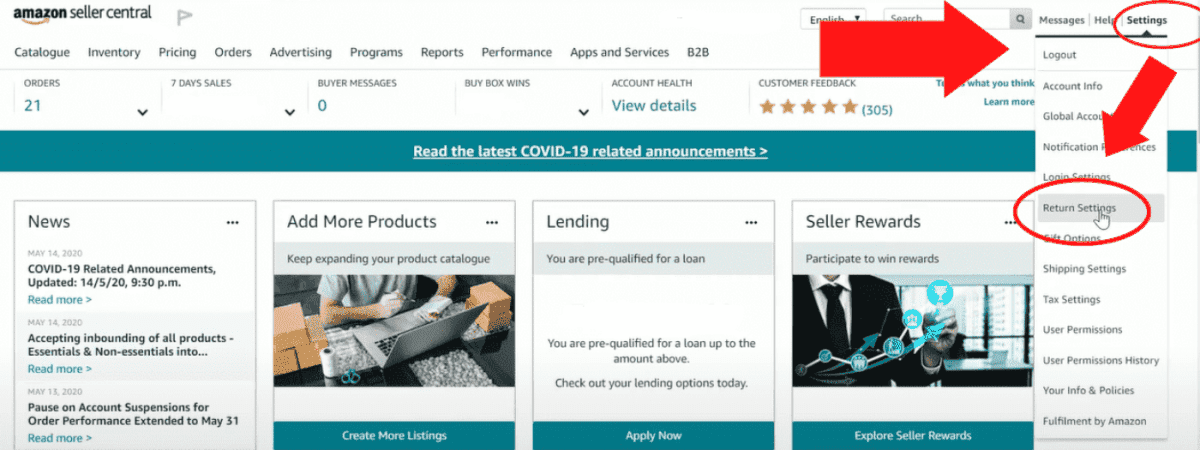

Toto customize your return authorization system, click on the buttons on Amazon Seller Central, as shown on the two screenshots below (the screenshots are for Amazon Seller Central India, but the menu layout is more or less the same for any seller country location):

In the second screenshot, you can see three options. One of the options says “I want to authorize each request.”

This is known as “manual authorization,” and choosing this will give you the freedom when and how you will authorize buyer requests for product returns.

Meanwhile, the two other options will not give you control. These give all authorizing power to Amazon, without regard for your decisions or choices.

Take note, however, that setting authorization to “manual” does not mean that Amazon will not step in to automatically authorize return requests.

According to the Help section of Amazon Seller Central, Amazon automatically authorizes seller-fulfilled return requests, for products sold within the United States, which fall within the return policy.”

In the said Help section of Amazon Seller Central, there are other conditions that enable products to fall under Amazon auto-authorized returns, even if you have adjusted the settings to “manual authorization.”

Now, going back to the topic of return authorization, let’s assume that you have chosen manual instead of the Amazon “auto authorized” returns setting.

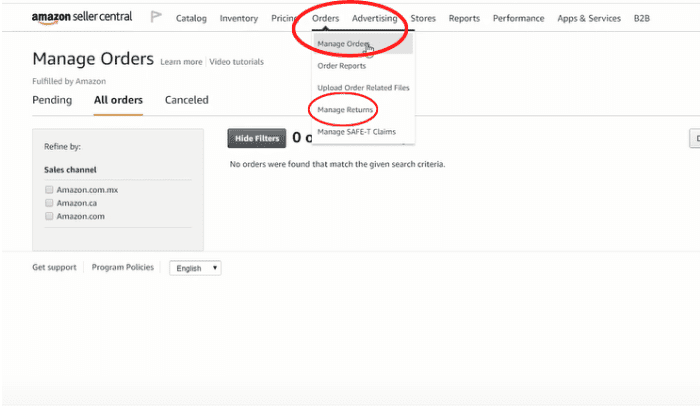

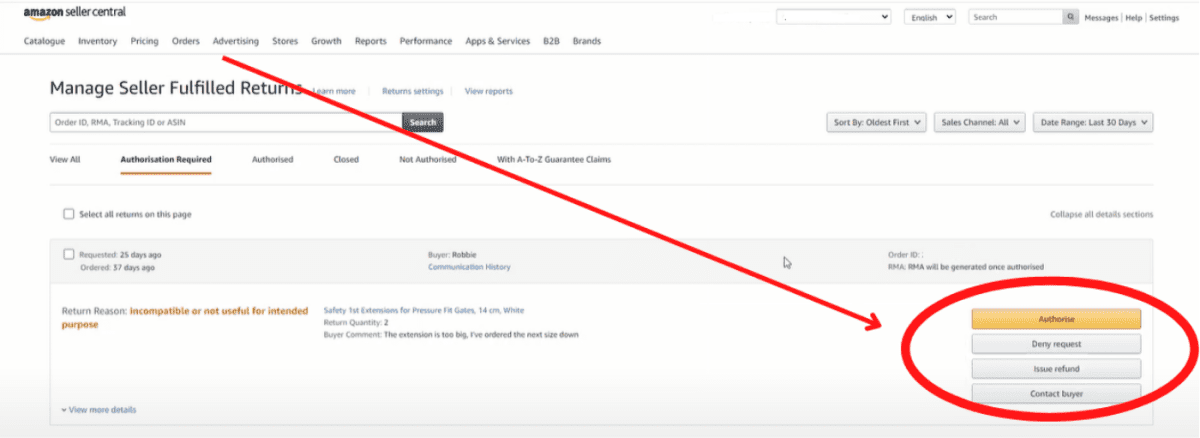

To check your current return requests, you can go to the “Manage Returns” page of your Amazon Seller Central main menu, as shown in the screenshot below.

After you click “Manage Returns,” you will be led to a webpage that looks like this:

As you can see above, there are four action buttons on the lower right hand side of a particular customer return request. These buttons are:

- “Authorize”

- “Deny request”

- “Issue refund”

- “Contact Buyer”

The four buttons mentioned involve either processing a return request or declining it. This will be further discussed later on.

Now that you know the basics of processing an FBM return request, let’s see how the process looks like under the FBA arrangement.

How to Process an FBA Return Request?

Fulfillment by Amazon (FBA) can be a breeze since Amazon deals with the dirty work of communicating with your customers and finding warehouses to store your merchandise.

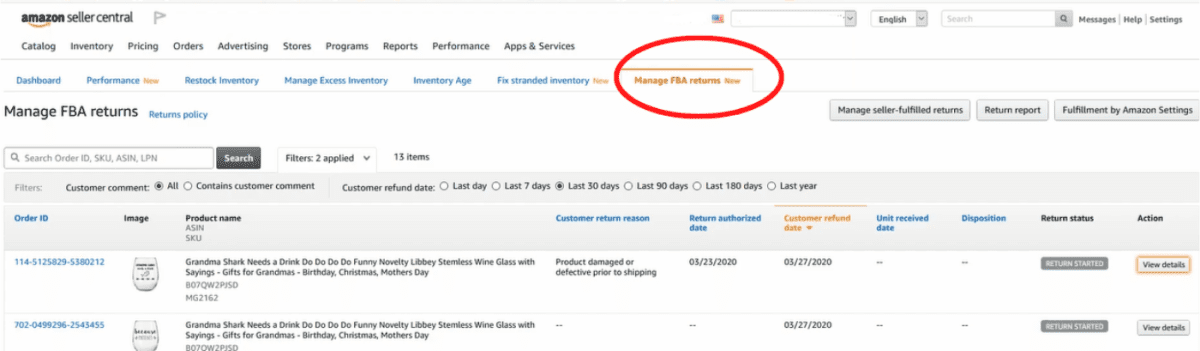

Managing return requests under the FBA arrangement also involves using Amazon Seller Central. However, the location of the webpage for dealing with such requests is slightly different, as you can see in the screenshot below:

The “Manage FBA returns” tab is a relatively new part of the Amazon Seller Central interface, and is a more enhanced and seller-friendly way of tracking FBA returns.

Since FBA arrangements let Amazon take control of the return and/or refund process, this part of Amazon Seller Central is generally for tracking purposes. It keeps you updated with vital information like how many products have been returned and why they were given back by customers.

Now that you have an idea how to access the menu or webpage to track your customer return requests, let’s dive deeper into the process of dealing with customer returns.

Amazon Return Process For Individual Seller Or Non-FBA

Many individual sellers fall under the Amazon arrangement called Fulfillment by Merchant (FBM), which basically means the seller handles most of the selling operations (unlike in FBA, where Amazon does most of the leg work).

As mentioned before, on Amazon Seller Central, there are four courses of action for FBM sellers. These include:

- Authorizing the return request

- Denying the request

- Issuing a refund

- Contacting the buyer

According to e-commerce and Amazon expert Lab 916, you don’t always need to issue refunds or contact buyers when dealing with return requests.

However, authorizing or denying a request is always a part of the process.

Let’s take a look at each of the four possible actions so we can get a better understanding of processing a request for FBM orders.

Authorizing Requests

The yellow button with the word “Authorize” is basically the “go signal” to begin the process of returning the product to the seller and issuing a customer refund.

Normally, whether or not you choose to manually authorize requests, Amazon automatically deals with return requests (both for FBA and FBM customers) as long as the item/s in question fall within the Amazon seller return policy.

In order to authorize manual requests, you must follow the following steps:

- Log in to Amazon Seller Central. Click Orders > Manage Returns

- Select a request you want to review and authorize.

- Once you choose to authorize a return request, Amazon will either provide you a randomly-generated Return Merchandise Authorization (RMA) number or you will be prompted to create the number yourself.

- You can also authorize multiple requests all at once. To do so, from the Manage Returns page – choose: “Authorize all selected returns” from the drop down menu.

The Amazon RMA number serves a lot of important purposes. According to highly-rated Amazon tools provider Sellics, the RMA helps you as a seller by enabling you to track which items in your inventory are new and which ones are returned by buyers.

The RMA tracking system also allows you to get data on which products are being returned and their quantity.

On the buyer’s end, clicking the “Authorize” button will enable the customer to receive an Amazon return authorization, which they can print and attach to the product they will return.

Authorizing requests is all well and good. But what about rejecting a customer’s return request? Read on to learn more about this.

Denying Requests

Though the customer is always right, it is not always right to serve customers at your business’ expense.

Declining a customer’s return request is usually avoided because of the negative reviews you may get as a seller. These kinds of reviews can harm your seller account health on Amazon.

Aside from this, A-to-z claims from customers may ultimately lead to seller account termination.

However, you can deny return requests, especially when the request is unreasonable.

One best practice you can keep in mind when denying return requests is contacting the buyer first and explaining your side well. Let’s discuss this further in the following section.

Contacting Buyers

Whether or not a return request seems unreasonable, it is best to contact buyers first so you can minimize financial losses.

It’s good to note that you can send an email to a buyer even after a return request is made.

Ideally, when you are able to resolve a product issue through contacting the buyer and providing quality customer service, the return and refund process can be skipped and you get to save a few pennies in your seller account.

Issuing Refunds

There is “fun” in refunds – for buyers that is. For sellers, however, it’s usually not the case.

Many ecommerce veterans, however, agree that issuing refunds is sometimes better than getting negative reviews from customers. After all, product returns only make up a small fraction of your total earnings, especially if you’re selling a lot of stuff on Amazon.

Don’t hesitate clicking the button for issuing refunds, especially if you want to avoid the hassle of negotiating with the buyer about who will pay for the return shipping fee. In many cases, the issuance of refunds quickly ends the product return process.

Now that you’ve seen how FBM sellers can implement return requests in accordance with the Amazon FBM return policy, let’s now try to answer another important question: How does Amazon handle returns for FBA sellers?

Amazon Return Process For FBA Seller

As you may already know, Fulfillment by Amazon (FBA) takes almost half the load out of an Amazon seller’s back.

Unlike in an FBM arrangement, sellers under the FBA scheme no longer need to do the heavy work of processing returns, refunds, and communicating with buyers.

If you’re an FBA seller, however, you need to be vigilant and aware of your seller account to make sure that the Amazon-processed refunds and returns are not eating into your profit margin.

In particular, you need to know how much you or Amazon will share in giving customers refunds and dealing with charges like referral fees.

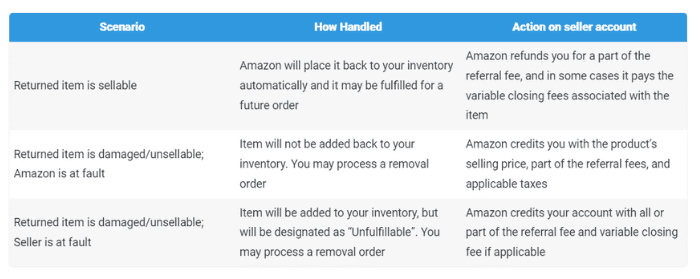

In the table below, the e-commerce veterans and startup founders of EcomCrew lay out the possible scenarios in FBA-related customer returns and how they affect Amazon seller accounts.

Two important terms stand out in the table above: removal order and referral fee.

A removal order is simply an instruction you give to Amazon so that a certain product in your inventory may be removed from a fulfillment center and brought back to your possession, the manufacturer of the product, or a third-party storage provider.

The removal order, as you will notice on the table, is applicable when the product that your customer returned to an Amazon fulfillment center is damaged or unsellable.

The fulfilled by Amazon return policy, as can be found on Amazon Seller Central’s help section, has a specific rule on this matter. The rule states that “[A] seller must submit a removal order within 30 days after arrival [of a returned product] at [a] fulfillment center.”

A referral fee, on the other hand, is a payment taken by Amazon from a seller for the platform’s role in making selling products easier. The fee is equal to a percentage of the total sales price of an item being sold by an Amazon seller.

For instance, you’re selling a self-help book on Amazon for $10. Referring to Amazon’s referral fee table on its webpage, the said item’s referral fee is 15% of the selling price. This means that for every book you sell on Amazon, you will pay the platform a referral fee of $1.50.

To summarize the table above, it is clear that for unsellable items, third party sellers can process a removal order regardless of who is at fault for the damage of those products.

For referral fees, in all three possible customer return scenarios, a full refund or a partial one can be awarded to the seller.

Now that you know more about removal orders and referral fees, let’s have a look at how they and other fees affect your operational costs.

FBA Removal Order Fee

As mentioned above, every returned item that you want out of your inventory requires a removal order. A fee is paid for each removal order.

In general, the calculation of removal fees depends on product size and weight. Since Amazon Seller Central has different web pages for different regions, having a look at the fee Help content for the region will shed light which measurement system and units are used for the region.

For U.S. sellers, you may refer to this Amazon Seller Central help content page for removal fee info.

Another fee that you need to be aware of as an FBA seller is what is called the returns processing fee, which you will discover below.

FBA Returns Processing Fee

The returns processing fee is part of the Amazon FBA return policy, especially for particular categories of products.

Some groups of products on Amazon enjoy zero return shipping costs. If you’re selling products like clothing and shoes, you or your customer won’t have to pay for the cost of shipping the goods to a fulfillment center in case some of the products need to be returned.

The free return shipping cost, however, comes at a price in the form of the returns processing fee.

The fee for returns processing is calculated based on product size, as can be found in this Amazon Seller Central help content section for sellers in the U.S. If you live or are selling in other parts of the world, check out the Seller Central help content for your region.

Extended Returns Timeframe

For products bought from FBA sellers, customers can file for return requests within 30 days after receiving their products.

The 30-day timeframe, however, can be extended in some cases.

For baby items in new, unopened condition, the timeframe can be as long as 90 days.

There are also certain products shipped during November and December that can be returned until the end of January of the succeeding year.

Though the set of products that Amazon allows to be returned until January may vary from time to time, an article from GO Banking Rates can give you a good idea of the kinds of merchandise with an extended returns timeframe.

How to refund tax?

Taxes on products sold on Amazon are generally included in the sale price. In the Amazon ecommerce space, a buyer can request for tax refunds whether he or she buys from an FBA or FBM seller.

The FBA tax refund process is pretty straightforward. All a buyer has to do is contact Amazon customer service with a detailed request for a tax refund.

To get a good look at the buyer side of this refund process for FBA transactions, check out this Amazon link.

FBM tax refunds, on the other hand, require a little more effort.

Amazon Seller Central has websites or portals across the world, with their corresponding Help section. For the sake of simplicity, the FBM seller tax refund mechanism discussed here came mostly from the Help section of the U.S. portal.

According to Amazon Seller Central USA, “if a buyer qualifies for tax exempt status, they can request a tax refund.”

The same Seller Central site mentions the following steps in processing a tax refund (again, this may change from time to time so regularly check out the website):

- Locate the order where a buyer has requested a tax refund in Manage Orders and click Refund Order from the Order Details page.

- At the top of the Refund order page, click Refund tax only.

Important: Unless the order was fulfilled by Amazon or tax is managed by Amazon, you will not see the Refund tax only button.

- Select Tax exempt buyer or Order from an unincorporated area.

- For Tax exempt buyer, choose an exemption reason.

- For Order from an unincorporated area, choose one or more of the jurisdictions that you will refund.

- Click Submit refund.

When it comes to tax refunds and returns, buyers seem to have the upper hand. But is there good news for Amazon sellers?

Actually, there is Sometimes, there is a way to reduce the refund amount deducted from your Seller Central account.

How, you might ask? Amazon’s restocking fee policy can shed light on this matter.

Amazon Restocking Fee Policy

Aside from being a way to save money due to lesser refund outflows, the Amazon restocking fee policy also guards against the dangers of unsellable inventory.

This is because according to the restocking fees guidelines of Amazon Seller Central USA, a seller can charge a buyer the restocking fee of a returned product, especially if the item is “damaged, defective, or in a materially different condition.”

In other words, a seller’s right to transfer the cost of the restocking fee to the buyer is a way to reduce losses which come as a result of a reduction in sellable inventory.

It is also good to note that when a product is returned outside of Amazon’s return policy (for example, a buyer returns a product more than 30 days after he received it), the cost of the restocking fee should also be shouldered by the concerned buyer.

The calculation of the restocking fee is quite simple. The fee is a percentage of the item’s price ( excluding shipping costs), which can range from 20% to 50% of the said price.

For more information, check out the table from this Amazon Seller Central USA Help section article.

Now you might consider this new information about Amazon’s restocking fee policy a gift. But as an Amazon seller, you can also be a gift to others, especially if your buyers want their gift returned.

Puzzled at the statement you just heard? Read on to learn what we mean.

Process Of Gift Returns

It’s the thought that counts. We often hear this quote related to gift giving.

Sometimes though, thoughtfulness alone is not enough to make gifts likeable. That’s probably why, unfortunately, some gift recipients want their gift returned to the giver.

You, as an Amazon seller, can be a gift to others by being good at processing gift returns. This guide could help you with just that.

Gift returns are highly similar to ordinary product returns. In fact, they are so similar, that gift return requests can also be found on the “Manage Returns” page.

Gift returns, however, are different from regular returns because they have a gift icon next to the return details of the “Manage Returns” page.

Before we proceed with the process of gift returns, let us discuss the two main parties you will communicate with during the process. They are the gift recipient and the one who purchased the gift.

Communicating with the gift recipient

In general, the person you will communicate with is the one who received the gift. This is to respect the privacy of the buyer who purchased the gift.

On the “Manage Returns” page, you can find a button labeled “Contact Gift Recipient.” Click this button to inform the recipient of vital information such as the difference in return benefits between FBA and FBM transactions, and the fact that refunds for returned gifts come in the form of Amazon.com gift cards instead of cash credits.

There are times, however, that you’ll need to talk to the buyer of the gift himself or herself.

Communicating with the customer who purchased the gift

The “Manage Orders” page contains the means through which you can communicate with the buyer of a gift. You can locate a buyer’s name next to “Contact Buyer.”

A part of the webpage, called the “Customer E-mail History,” will display all order correspondence from both the receiver and the giver of a certain gift.

Refunding a gift return

In every gift return refund transaction, you can refund either the gift recipient or the one who purchased the gift.

To refund a recipient, head over to the “Manage Returns” page. Here you will find the “Issue Refund” button, which will send an email to the recipient once you clicked the button.

The email contains a refund in the form of an electronic gift card, which the recipient can use to buy stuff on Amazon.

If you need to refund the one who bought a certain gift, you can click the “Refund Buyer” link within the “Manage Orders” page.

Well, that’s about it for gift returns. But hang on, because there are still a lot of gifts to come. Gifts in the form of more juicy information about Amazon’s Return Policy.

How Are You Affected By Amazon’s Return Policy?

The Amazon return policy for sellers of any category is highly dependent on the Amazon FBA return policy.

According to Amazon, FBM sellers’ return policy should generally comply with the FBA return policy. This means, for example, that even if you as an FBM seller don’t feel that a 30-day return period is reasonable, you have to adjust since the Amazon FBA return policy states a customer can request returns up to 30 days after product delivery.

The relative superiority of the FBA return policy also means that, in paying for restocking fees, you can’t force a customer to shoulder the fees, especially if the returned products are in good condition.

This is because under the FBA policy, only damaged or altered goods can obligate a buyer to shoulder restocking fees.

In short, whether you’re an FBA or FBM seller, you should keep yourself updated regarding the Amazon FBA return policy in order to stay competitive on the ecommerce platform.

Speaking of remaining competitive, we have another automation option for you that can give you a competitive edge in the area of customer return processing.

Returnless Refunds

As you may have already learned from our guide, FBA and FBM sellers can issue refunds even if their customers didn’t return the products in question (a case of “returnless refunds”).

But did you know the process of returnless refunds can be automated?

“But wait a minute,” you might ask, “Why would I want to automate returnless refunds? Wouldn’t that make me lose a lot of money?”

Well, it’s normal to be afraid of the financial dangers of the automated processing of returnless refunds. But three things can help you combat this fear. They are:

- Accepting the fact that, as an Amazon seller, you will experience one or more return requests at some point in your online business life

- Recognizing that some product categories are less prone to returns compared to others

- Becoming aware that, sometimes, for products with expensive return shipping costs, it’s more cost-effective to conduct returnless refunds

These three, combined with Amazon’s returnless refunds automation system, could make it possible for you to earn profits while eliminating the burden of having to deal with refund requests all the time.

How is this possible?

First, go to your “Settings” menu, which you can find in the top right corner of your Amazon Seller Central webpage. Check out the screenshot below:

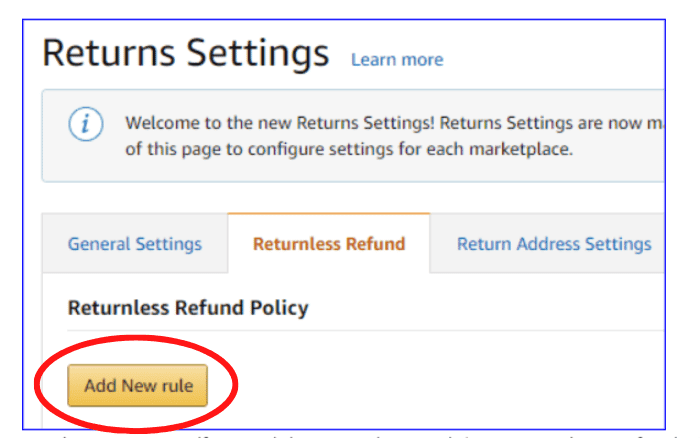

Then, click “Settings.” This will lead you to the “Returns Settings” menu, which looks a bit like this:

From this point, you can click the yellow “Add New Rule” button, where you can set a price range or specific product categories where you can implement an automatic returnless refund rule.

If we’re going to apply the three best practices mentioned above, the best categories where you can implement automatic returnless refunds include books, which usually has a return rate of only about a little less than 10%.

On the other hand, you should avoid automating refunds for consumer electronics, which have an average return rate of about 40%.

Return percentages are all well and good in risk management. But what other statistics are important in order to maintain a good risk-reward balance while selling on Amazon?

How about the number of customers who maliciously take advantage of the rather liberal Amazon return policy? Is this number a cause for concern or comfort?

Do Customers Abuse Amazon’s Return Policy?

The return policy of Amazon is meant to ensure a great customer experience. Thus, it is easy for buyers to return merchandise they don’t like if they bought the goods from this ecommerce platform.

Because of this rather relaxed policy, a lot of customers return products even if the items in question have no defects. There are even people who “do the old switcheroo,” where they return defective items other than the ones they bought on Amazon in order to get a refund while keeping the working products.

But are fraudulent returns like these widespread? Should you, as a seller, worry about your profit margins because of deceptive customers?

A Forbes Magazine online article shows an interesting statistic regarding these burning questions. According to the famous business magazine, just a little over 1% of customers on Amazon are making excessive or fraudulent returns.

It seems that, statistically speaking at least, the fraud committed on Amazon should not be cause for alarm for sellers like you.

What To Do With Your Returns

Whether your Amazon business is FBA or FBM, the following general guidelines would ensure that your processing of returns would strike a balance between providing great customer service AND ensuring a healthy profit margin:

1 – All returns should at least be dealt with promptly, preferably within 24 hours of receipt of the return request.

By “dealt with,” it could mean either processing the refund outright or at least contacting the customer to strike a deal if possible.

2 – Ensure that most of your product lineup consists of low return-rate items like books, kitchen tools, etc. Selling mostly low-risk items ensures higher customer satisfaction.

Avoid including too many high-return goods like phones or other electronic goods.

3 – Automate refunds (regardless of whether or not the products in question are returned) for items that are really sold cheap and/or the ones with extremely high shipping cost.

4 – Avoid denying customer requests for returns. However, if you have to, give a really good reason for doing so.

Now that you know all about Amazon’s return policy for sellers, let’s have a look at Amazon’s more exclusive flipside, Amazon Prime.

Seller-Fulfilled Prime Returns

Finance advisory website NerdWallet describes Amazon Prime as “a subscription service from Amazon [that] gives members access to exclusive shopping and entertainment services…”

Like Amazon’s ordinary shopping service, Prime also accepts third-party online sellers. If you become a seller for Prime, you will be able to directly deliver products from your warehouse to your customers, using the Prime badge.

Some say this badge is a badge of honor, so selling on Prime is much sought after.

The returns process for Prime, however, is like a hybrid of FBA and FBM. Like in FBM, Prime third-party sellers are mostly responsible for issuing a refund to their customers who request a product return. However, like in FBA, there are instances when Amazon will do that for you.

But perhaps the most unique aspect of seller-fulfilled Prime returns is the power of sellers to dispute any refund administered by Amazon. This dispute, which could give sellers the power to get back the money they lost in refunds, is called a SAFE-T claim.

To learn more about Prime’s seller-fulfilled refund reimbursement policy, you may read all about it here.

Before this Amazon return policy guide comes to an end, let us go through some Frequently Asked Questions and the short answers to these queries.

FAQ

How Does Amazon Return Work For Sellers?

Though the Amazon return policy works mostly for the benefit of buyers, the policy also serves sellers through lenient rules on the payment of restocking fees for returned but damaged items.

Do Amazon Sellers Have To Accept Returns?

More often than not, yes they have to. However, in rare cases where return requests are unreasonable, they may be declined.

That’s why if you’re a seller, you should be careful in denying such requests to avoid the generally dreaded A-to-z claims from customers. This claim could ultimately lead to warnings or seller account termination.

Do Sellers Lose Money On Amazon Returns?

Some Amazon sellers lose money processing customer returns. However, this can be avoided through carefully analysis of your seller data.

Specifically, determine which products you sell have a high return rate and which are less likely to be returned. Knowing this information can help you stock on products that have a lower probability of being returned.

Who Pays for Amazon Returns?

Though there are many times sellers have to shoulder the cost of returns, there are instances when the Amazon seller refund policy favors sellers.

This is true in certain cases of undelivered, lost, or damaged products sold by FBA sellers. In these unfortunate cases, Amazon generally pays for the returns.

What Percentage Of Amazon Products Get Returned?

Many ecommerce experts claim that items like books, CDs, and household items have reasonable return rates of 5 to 10%. On the other hand, clothing and electronics goods tend to approach the financially unhealthy 40% mark.

Can Customers Return To Amazon After 30 Days?

In exceptional cases, like for baby items that are unopened or untampered, customers can return products to Amazon even after 30 days have passed since they received the goods.

Sending a return request even beyond the 30-day rule is also possible for many select products shipped to customers in November and December.

Do FBM Sellers Have Total Freedom in Customizing their Return Policies?

Though FBM sellers may attract customers by slightly deviating from the Amazon third party seller return policy, many ecommerce experts do not recommend doing so frequently. Try to match as close as possible (or even exceed) the said Amazon policy.

How to Change Return Policy on Amazon Seller Central

To change the return policy for your Amazon seller account, follow these steps:

- Log into your Amazon seller account.

- Go to the “Settings” section of your account.

- Select the “Return Settings” option.

- Edit your return policy as desired and save the changes.

Note: The exact steps may vary depending on the type of seller account you have and the Amazon marketplace you sell on. It’s also important to note that some marketplace restrictions may apply, such as a minimum return window.

Are Amazon sellers allowed to give partial instead of full refunds?

The Amazon partial refund policy is quite generous to both FBA and FBM sellers, especially in particular cases like the following:

| Item | Refund |

|---|---|

| Item returned in original condition, within the return window (which is generaly within 30 days of delivery to customer) | 80% of the item price |

| CDs, DVDs, VHS tapes, etc that are taken out of their packaging by a customer | 50% of the item price |

| Damaged or used items (where usage or damage is not the fault of Amazon or the seller) | Up to 50% of the item price |

| Unpacked software or video games (where usage or damage is not the fault of Amazon or the seller) | 0% of the item price |

For example, you as an FBM seller delivered to a customer a DVD movie worth $20. The customer took the DVD (which did not have any defects) out of its plastic packaging, played it, and eventually had it returned because he didn’t enjoy the film.

In case you authorize and process the return, you only have to pay the customer $10 in refunds!

How does Amazon deal with defective items and how does this dealing affect sellers?

As mentioned in the preceding FAQ item, customers generally pay for (through partial refunds) the cost of items which were damaged by them and not through the fault of Amazon or the website’s third-party sellers.

The Amazon defective return policy also takes the side of the sellers, especially when a product is damaged on the site or address provided by a customer to either Amazon or third-party sellers.

For example, if your customer lives in an apartment in New York City and that is where the product you or Amazon delivered got damaged, the customer won’t be able to file a return request.

Whether you are an FBA or FBM seller, you are protected from any such requests.

Conclusion

It is clear from this guide that although Amazon returns cost sellers some money, there are ways to maintain profitability and credibility while selling on this platform.

This article has explored the Amazon return policy for sellers in detail, including Amazon Prime, as well as how these policies affect sellers on those platforms.

Insights about Amazon’s return policy are best combined with knowledge of how conversion rates can act as vital signs to show how fast your product listings turn into profit.

Read our article if you want to explore the exciting world of conversion rates.

Once you see how valuable conversion rates are, it’s time for Amazon buyers to see how important your products are. Learn how you could push your products near the top of Amazon’s search results page by browsing our Amazon listing optimization blog post.