What is an Account Level Reserve (Amazon)? What do Account Level Reserves mean for Amazon sellers like you?

You’ve come to the right place for answers.

As a veteran Amazon seller, I know the ins and outs of account management on Amazon. I want to help fellow Amazon sellers like you, so I wrote this guide.

I will discuss all you need to know about Amazon Account Level Reserves. I’ll explain what an Amazon reserve is, how it works, why Amazon Reserve funds are necessary, how to find your current Amazon Reserve amount, and more.

Let’s begin.

What Is Account Level Reserve (Amazon)?

Account Level Reserve is a fund that Amazon holds to cover potential refunds or chargebacks on your account. Another term for it is Unavailable Balance.

When a seller has an Account Level Reserve, Amazon will hold a certain amount of money from that seller’s account balance to make sure that the seller can still pay Amazon if they are unable to fulfill their orders.

This reserve is a percentage of your total sales, and Amazon holds it as a precaution in case you can’t fulfill a refund or chargeback. Amazon bases the percentage on your account history, typically around two percent.

For example, you have an Account Level Reserve of two percent. If you make a sale for $100, Amazon will hold $2 in reserve in case there’s a chargeback for the sale.

An account-level reserve is important because it protects Amazon from financial loss if a seller cannot fulfill a refund or chargeback.

This reserve also gives sellers peace of mind, knowing Amazon protects their accounts against potential issues.

Account Level Reserve is a necessary part of doing business on Amazon, and sellers need to understand how it works.

By knowing how this feature works, you can protect your account and avoid any potential problems.

What Are Amazon’s Reserve Tiers?

There are three different tiers that Amazon can place sellers in, with each tier holding a different percentage in reserve.

Tier I

New Amazon Pay merchants belong to this group.

In this tier, the reserve amount is all payments processed through the seller’s account during the last seven days. Additionally, Amazon includes the value of the outstanding transaction disputes in the reserve amount.

Tier II

Sellers in Tier Two have processed at least 100 orders and have been Amazon Pay merchants for at least one year.

Here’s how Amazon calculates the reserve amount:

Amazon includes 3% of the daily processed payments (an average of the previous 28 days) or the total amount of all unresolved transaction disputes, whichever is higher.

Tier II-Plus

Sellers who have kept their ODR at less than 1% on average over the previous 60 days are in this group.

The value of all unresolved transaction disputes serves as the reserve amount for this category.

Amazon Account Level Reserve for FBM Sellers

An Amazon FBM seller is a seller who uses Amazon’s Fulfillment By Merchant program. The seller is responsible for shipping the products to the customer rather than Amazon.

The main difference between an FBM seller and an FBA seller is that an FBM seller does not store their inventory in Amazon’s fulfillment centers. Because of this, Amazon does not have as much control over the FBM seller’s inventory, and thus, they are considered a higher risk.

Amazon FBM sellers often have a higher reserve than FBA sellers. The amount Amazon holds in reserve depends on the sales volume and number of customer complaints.

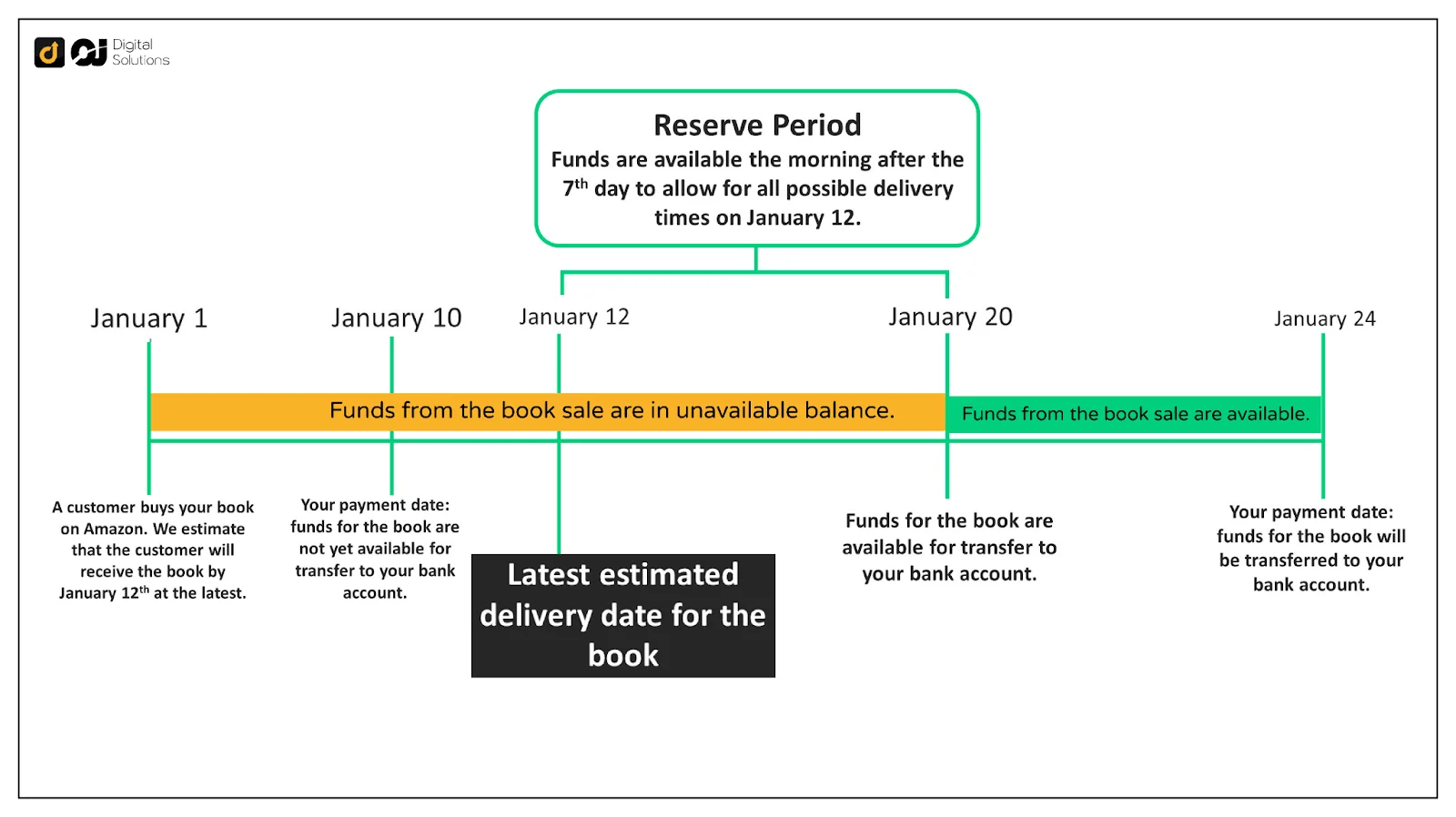

In the case of FBM sellers, Amazon holds funds in the Account Level Reserve according to the estimated delivery date, not the actual delivery date. Amazon will hold the funds for seven days after the estimated delivery date, even if the products arrive earlier.

When Is My Amazon Account Level Reserve Available for Payout?

The amount in your reserve account depends on the timing of your sales deliveries, the volume of those sales, and the consistency of your payments.

Amazon keeps your sales revenue in the reserve account until the reserve period, seven days following order delivery.

After seven days, Amazon disburses the funds to you.

For example, if a customer buys an item from you on December 20th, Amazon will process and ship the order on December 21st.

The customer will receive the order on the 26th, and the revenue from that sale will be available seven days after delivery, on January 2nd.

Your account level metrics, including seller standing, sales volume without issues, the duration as a seller, and seller feedback, affect the amount held in your Amazon Account Level Reserve.

Because of this, new Amazon sellers will hold back more reserves than veteran sellers. Payouts frequently take 4-6 weeks to arrive after the initial sale.

Amazon must allow sales amounts to accumulate to form your account-level reserve. Therefore, new sellers must have realistic expectations regarding when they will receive their first payment.

Why Did I Get A Reserve On My Account?

Here are a few reasons Amazon sellers get Account Level Reserves in their seller accounts.

Amazon A-to-Z Guarantee Claims

Amazon’s A-to-Z Guarantee policy lets buyers return their orders for full refunds if they’re unsatisfied with the product, delivery time, or the overall customer experience.

For example, if a buyer orders an item from you, and it arrives much later than the estimated delivery date, the buyer can request a refund and file an A-to-Z Guarantee claim.

In this situation, Amazon holds the amount in account reserves until you resolve the issue with the buyer.

Amazon Account Reviews

Amazon can review and suspend your account anytime if it detects suspicious activities.

An account suspension may surprise you, but you shouldn’t worry if you’re sure you did nothing wrong. Amazon takes the platform’s security extremely seriously, so it takes extra steps to verify unusual account activity.

Low Seller Performance

Amazon rates seller accounts from 0 to 100 according to the following factors:

- Customer reviews (Negative feedback rate)

- Customer service

- Shipping time

- Order cancelation rate

- Chargebacks

- A-to-Z claims

A low seller score can initiate an Amazon Account Level Reserve. Maintain a high seller rating by providing exceptional customer service, letting you avoid account reserves.

Tax Requirements

Depending on your location, your Amazon seller account may be subject to specific tax requirements.

Amazon must withhold funds to pay the taxes you incurred for the year. The platform may hold funds in reserve until you resolve your tax liabilities.

How To Find the Amazon Current Reserve Amount

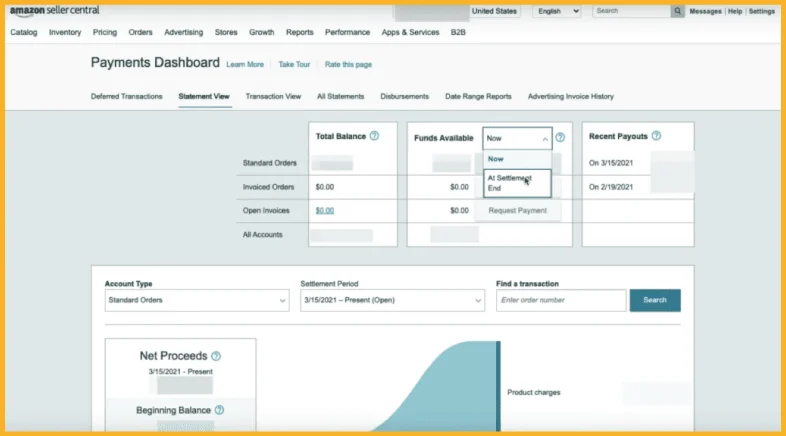

You can find the current funds in reserve in the Account Level Reserve section of the Statement View tab of your Payments report. This amount will fluctuate in line with your payment history and sales volume.

Additionally, you can view your reserve percentage, which represents the portion of your Amazon Seller FBA sales revenue that Amazon will keep in reserve.

Here’s how to access it:

1- Go to Reports.

2- Click Payments, then click Charts.

- The Net Proceeds represent the anticipated payout for the payment cycle.

- The Beginning Balance is the amount of reserves from the previous payment cycle

- The Sales figure is the amount you earned during a specific time.

- The Refunds section refers to Amazon’s reimbursements.

- The Expenses include your monthly professional account selling fee, commissions from sales, and shipping costs.

- The Account Level Reserve is the amount Amazon holds during a given period.

Your Account Level Reserve will carry over to the first balance of the subsequent period.

How To Avoid an Account Level Reserve On Your Amazon Seller Account

Here are a few tips to avoid having an Amazon seller Account Level Reserve:

- Sell high-quality products that will result in fewer customer complaints.

- Fulfill orders promptly and accurately to avoid negative feedback and to keep your customer satisfaction rating high.

- Maintain a good history of on-time payments.

- Monitor your sales volume and adjust your prices accordingly. Allow your sales volume to grow steadily over time.

- Keep your shipping costs low.

- Respond quickly to any customer inquiries or complaints.

What To Do When You Have An Account Level Reserve

If you already have an account-level reserve, don’t panic. You can improve your situation and avoid having the reserve in place for long.

Here are a few things you can do

Ask for An Increased Credit Card Limit.

If you have a good history of selling on Amazon, you can ask your credit card company for an increased credit limit. Doing so gives you more room to make sales without worrying about exceeding your limit and incurring fees.

Get a Bank Term Loan.

If you have a good relationship with your bank, you may be able to get a term loan. Doing so can give you the funds to cover your Account Level Reserve and keep your business running smoothly.

It is, however, important to note that you will need to have a good credit score to qualify for a loan.

Get an Online Business Loan.

There are many alternative financing options available for small businesses. Some of these options include online business loans.

These can be a good option if you don’t qualify for a bank loan. The application process is usually quick and easy, and you can get funds deposited into your account in as little as 24 hours.

Tap Into Your Savings.

If you have savings, you can use them to cover your Account Level Reserve.

This option isn’t ideal because it can strain your finances, but it may be necessary if you don’t have any other options.

Ask Suppliers for Longer Payment Terms.

When your money is in an Account Level Reserve, it can be difficult to meet your financial obligations.

One way to ease the strain on your finances is to ask your suppliers for longer payment terms, giving you more time to pay them back and avoid defaulting on your payments.

What Are Amazon’s Seller Payment Terms?

Amazon typically pays you every two weeks. Every payment includes 14 days’ worth of your orders delivered at least seven days prior (minus Amazon’s fees).

The date you registered as a seller will determine the precise dates of each payout. Unlike some marketplaces, Amazon may not always start processing payments on the first and fifteenth of each month.

Since they value customer satisfaction, Amazon pays out proceeds seven days after the most recent estimated delivery date. Holding back your payouts gives customers time to review their orders for any problems.

If a customer is unsatisfied and requests a return within seven days, Amazon will process the request using the funds it has set aside.

Image Source: yoursellingguide.com

Amazon’s Seller Payment Cycle and Amazon Seller Payment Disbursement Schedules

Once the seven-day Amazon Account Level Reserve holding period has ended, all sales are eligible for payout. The next payout date will be 14 days from your early payout if you choose to get paid early, resetting the payment date.

It will take two to five days for you to receive the funds in your bank account if you choose to receive payments via the Amazon Settlement payout. Here is an example timeline for the payout schedule from Amazon:

It’s typical to wait longer than 14 days to get paid.

Here are a few causes for this:

- The remaining balance will roll over into the following payment period if you deliver orders in under seven days from the date of your payout.

- It may take three to five business days for actual money transfers to appear in your account. Thus, Amazon pays you every 14 days as is customary.

- As an Account Level Reserve, Amazon may keep all or a portion of your payment for over 14 days.

Frequently Asked Questions (FAQs)

Can Amazon Legally Hold Your Money?

Yes. Amazon can legally hold your money. They are a business and have the right to protect their interests.

When you sell on Amazon, you agree to their terms and conditions, including giving them the right to hold your payments for up to 14 days.

As we have seen, they hold part of your revenues as an “Account Level Reserve.” to protect themselves against chargebacks, refunds, and other risks associated with selling online.

How Long Does Account Level Reserve Last?

Account Level Reserve is a temporary hold on your funds. The funds are held for 14 days to protect Amazon against chargebacks, refunds, and other risks associated with selling online.

After 14 days, Amazon releases the funds, and you will receive your payment. If there is an issue with the product, Amazon may hold the reserve balance while Amazon investigates the issue.

Why Is My Amazon Account Level Reserve Negative?

If your Amazon Account Level Reserve is negative, you have a balance due to Amazon.

This situation can happen if you have outstanding fees or charges, such as refunds or chargebacks, and the amount of money in your Account Level Reserve is insufficient to offset this balance.

You will need to pay this balance before you can withdraw any funds from your account.

The Bottom Line

I hope my guide on Amazon Account Level Reserves has made it easier for you to understand the process and why it’s necessary.

An Amazon Reserve is just a precaution. In most cases, it’s nothing to worry about. However, if you want to continue as an Amazon seller, you must keep your account in good standing by resolving issues with customers promptly.

You wouldn’t want Amazon to suspend your account and have to go through the hassle of retrieving it.

One Response

Hi mate ive got £570 in my reserve on Amazon seller account haven’t sold anything on there for ages it says it should be available in 14 days but i haven’t sold anything for months