What is a private-label credit card, and how will it help your business?

You’ve come to the right place for answers.

Merchants can entice customers with the perks of their private-label credit cards, whether they sell products online or in a physical store.

Research shows that the value of private-label card purchases has risen in the last few years, and experts expect the trend to continue.

If you’re a business owner or retailer wondering how to give your store a touch of novelty, consider offering private-label credit cards.

Let’s discuss everything you need to know about private-label credit cards. I’ll also show you the pros and cons of private-label credit cards to help you decide if they suit your business.

Let’s begin.

What Is a Private-Label Credit Card?

Have you ever shopped at a store and seen a salesperson offer shoppers credit cards or store cards? The card the salesperson is offering is most likely a private-label credit card.

Also known as a white-label credit card, it is a store-branded credit card you can use at a specific retailer.

It works like a standard credit or debit card but doesn’t have a credit card network logo (Visa, Mastercard, etc.). Instead, it has the store’s branding, and the cardholder can only use it at that specific retailer.

Like typical credit cards, a private-label card is a tool for borrowing money.

A company offering private-label credits can encourage customers to buy expensive items or multiple products simultaneously because they don’t have to pay the total cost upfront. Financial institutions collect payment later.

The specific store can also offer promotional financing with low-interest rates, 0% interest, or deferred interest.

Others may offer an extension for the refund of unwanted purchases.

This strategy is excellent for people who frequent certain stores because their continued patronage allows them to earn rewards and enjoy discounts.

Some companies that offer private-label credit cards include Ann Taylor, Banana Republic, and American Airlines. Many restaurants, hotels, and fashion boutiques offer private-label credit card programs.

How Do Private-Label Credit Cards Work?

A private-label credit card may have a store name, but the issuing bank manages the credit plan and payment collection.

Alliance Data Systems, Wells Fargo, TD Bank, Citi Retail Services, Comenity Bank, and Synchrony Financial are companies that issue private-label credit cards.

These third-party financial institutions help with card issuance, payment collection, and credit funding. They also focus on technology integration for digital assistance and mobile payments.

These financing partners also help assure cardholders and protect them from shady practices (like hidden fees) by the specific brand issuing the private-label card.

The third-party financial institution also shares profits from private-label credit card transactions with the retailer.

The system for private-label cards is similar to regular credit and debit cards. The financial institution charges interest on credit card balances and fees on late payments.

On the other hand, the retailer will avoid payment processing fees, which translates to more profits.

What Are Examples of Private-Label Credit Cards

Here are private-label credit cards you can get from various retailers:

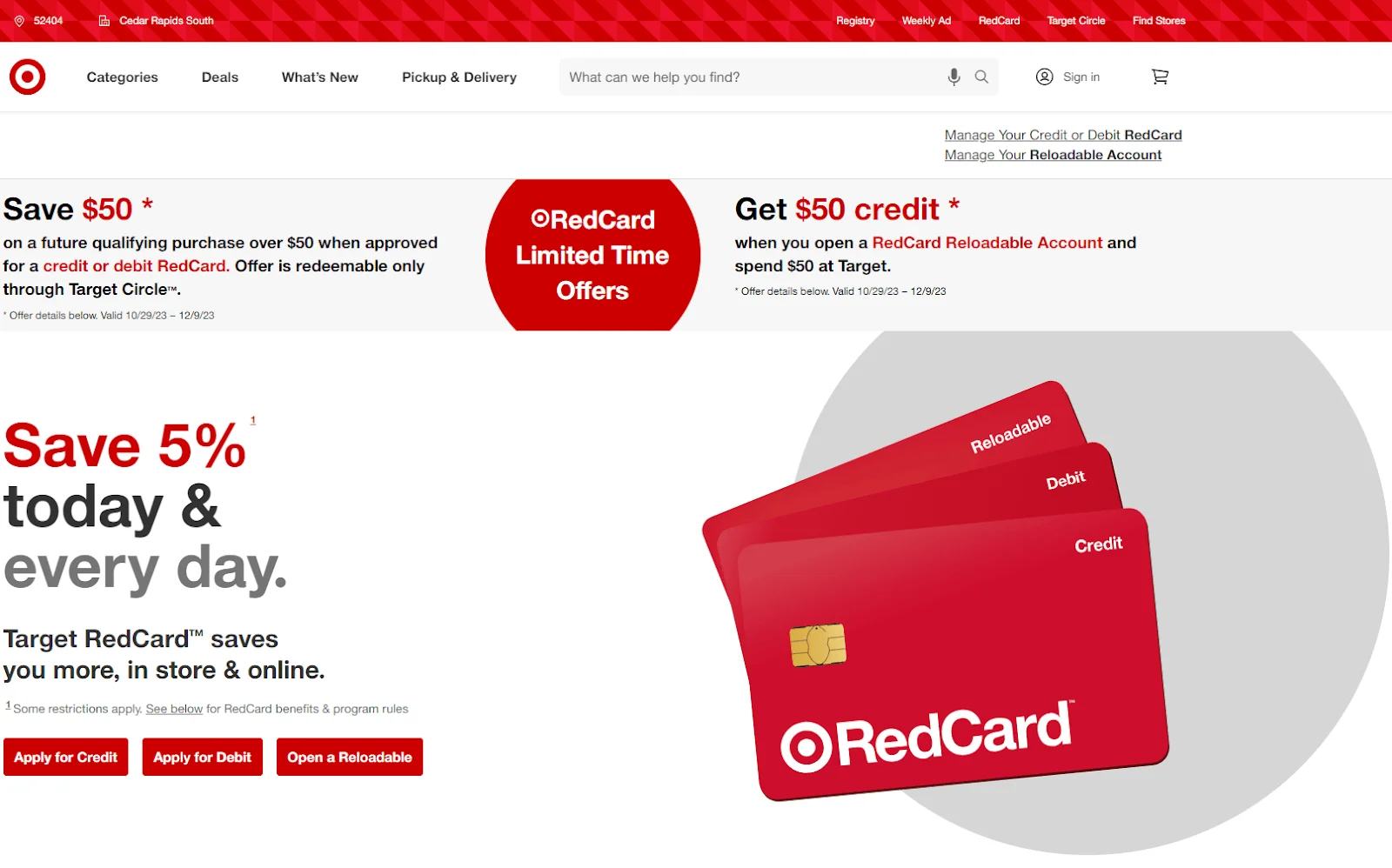

Target RedCard

The Target RedCard is a private-label credit or debit card you can get from Target, one of the biggest retailers in the US.

Here are some of the benefits of a Target RedCard private-label credit card (restrictions apply):

- 5% off at Target stores and Target online every day

- No annual or monthly fees

- Free two-day shipping

Note: This card differs from Target Circle, Target’s loyalty program.

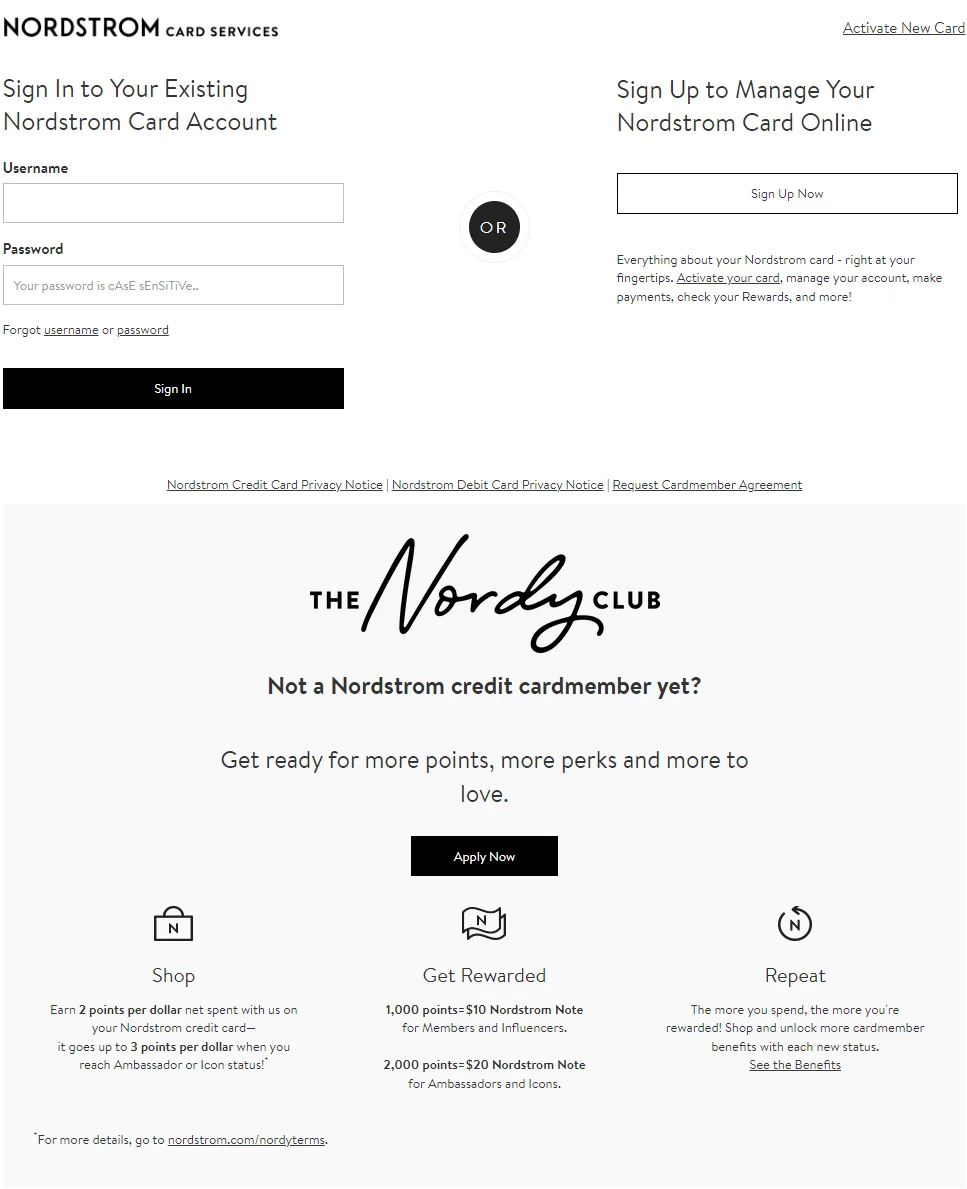

Nordstrom Card

Nordstrom is one of the biggest luxury department store chains in the US.

This retailer offers the Nordstrom Card, a private-label credit card, with the following benefits (restrictions apply):

- Earn two points per dollar spent (three points for Ambassadors and Icons)

- 1,000 points equals $10 Nordstrom Note (Members and Influencers)

- 2,000 points equals $20 Nordstrom Note (Ambassadors and Icons)

- Unlock more wards the more you spend

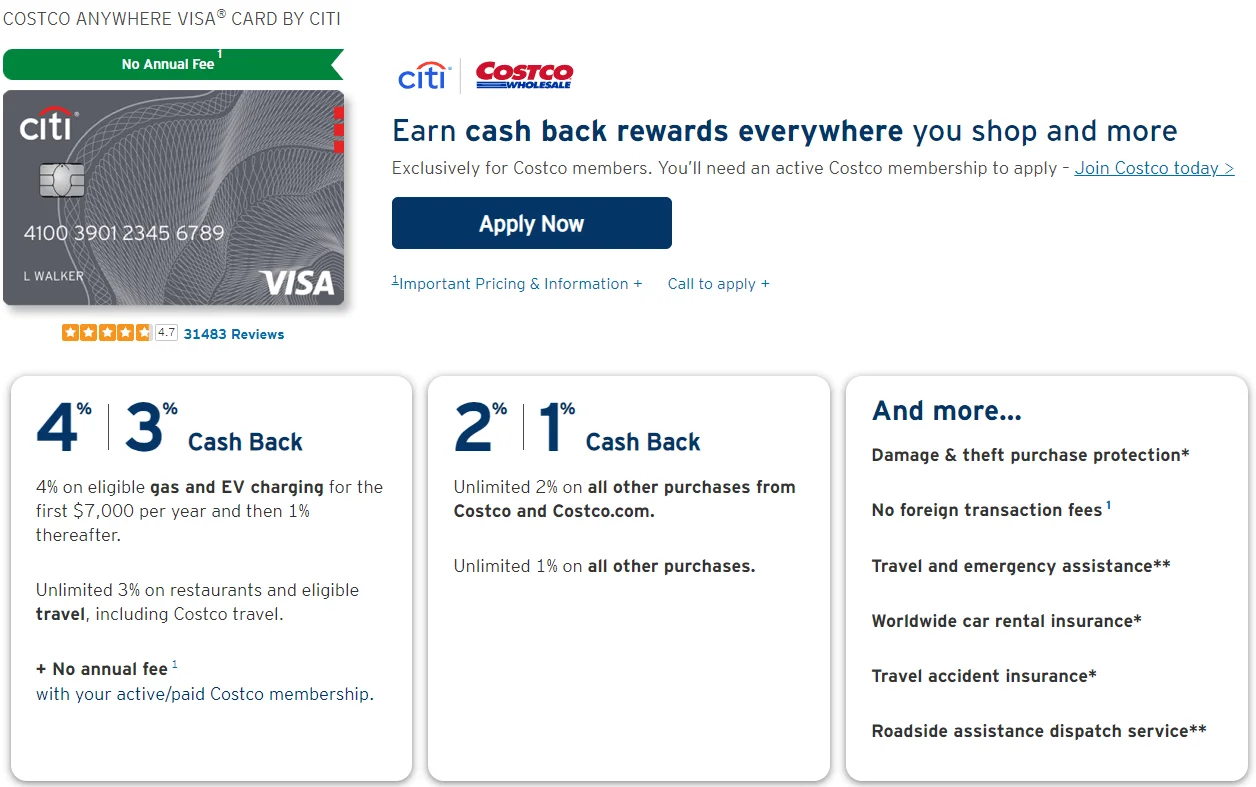

Costco Anywhere Visa Card (by Citibank)

You can apply for a Costco Anywhere credit card on the Citibank website if you have an active Costco membership.

Here are some of the benefits of Costco Anywhere (restrictions apply):

- 4% cash back on eligible gas and EV charging for the first $7,000 annually (1% after $7,000)

- 3% cash back on restaurants and eligible travel, including Costco travel

- No annual fee (with an active Costco membership)

What Are the Pros and Cons of Private-Label Credit Cards?

| ✅Pros | ❌Cons |

|---|---|

| Loyalty rewards | High annual percentage rate |

| Brand recognition | Limited usage |

| Better deals and more profits | Deferred payments |

Pros of Private-Label Credit Cards

Starting a private-label card for your small business can help you earn your customer’s trust and loyalty. Here are some of the numerous benefits of private-label credit cards for businesses and shoppers.

Loyalty Rewards

Nothing sparks a shopper’s interest like the thought of rewards. Customer loyalty points and rewards send customers a message that they are valued, increasing customer retention.

Buyers are more likely to spend money with your store’s private-label credit card when making purchases, which allows them to earn rewards.

Brand Recognition

Private-label credit cards don’t have Visa or Mastercard logos like other credit cards. Instead, companies customize their card designs to highlight their brand.

A private-label credit card can help solidify your brand’s identity.

Better Deals and More Profits

Spending money at your store is a no-brainer when offering perks like promotional financing and VIP features to incentivize customers.

When more people shop at your store, you’ll see more profit opportunities and can offer fantastic deals. Doing so would further encourage potential buyers to purchase and increase customer retention. It’s a cycle that benefits both the seller and the customer.

Cons of Private-Label Credit Cards

Here are some challenges that come with private-label cards.

High Annual Percentage Rate

Card issues state the interest rate of a credit card as an annual rate or APR.

The average private-label credit card has a higher interest rate than non-retail credit cards. This issue won’t be significant if buyers pay the entire monthly balance. Doing so can even help people build a high credit score.

However, the high APR can be a real burden for those who can’t pay their balance in full every month.

Limited Usage

The main drawback of private-label cards is their restrictive usage.

Since customers can only use private-label cards at one store (the one retailer that issued the card), their use is somewhat limited compared to regular credit cards.

Deferred Payment

Deferred payment is a double-edged sword.

It can help customers save money if they pay off their purchase entirely by the end of the promotional period.

However, they pay more in deferred interest if they fail to meet payment deadlines.

How To Start a Private-Label Credit Card

Consider these factors before starting a private-label credit card program for your business.

Compliance

When starting a private-label card program, prepare to abide by a long list of rules and regulations. You must also consider data security and the staffing required to handle the extra work.

Branding

Carefully develop your credit card design, especially if your business is still in its early stages. You want a design that will last a long time.

Support

Once you offer a private-label credit card to customers, the volume of inquiries and customer support requests will increase. Ensure you have a team capable of providing customer support.

You can approach banks that can serve as your credit card issuer once you’re ready to offer people a private-label credit card program.

What Are the Alternatives to Private-Label Credit Cards?

Here are options you can pursue if you’re not ready to launch a private-label credit card program.

Co-branded Credit Cards

What is a co-branded credit card?

Co-branded credit cards work like private-label cards. The difference is that two parties sponsor co-branded credit cards: 1) the retailer offering the co-branded credit card and 2) a bank or payment processing network like Visa, Mastercard, or American Express.

Co-branded credit cards bear the card network’s logo, hence the term “co-brand.” They are more versatile because people can use them at any store that accepts credit card payments.

Customers can still enjoy the rewards and privileges you offer with the co-branded credit card.

Loyalty or Rewards Cards

A loyalty or rewards card is adequate if your primary purpose is boosting brand recognition for your small business.

While a loyalty or rewards card won’t offer easy payment schemes, loyalty programs reward a customer’s continued patronage.

Your store card can give loyalty points whenever a customer buys something from your store. The customer can use these points on a future purchase by exchanging them for other items in your store.

Customers also love rewards like discounts, freebies, and access to limited-edition products and members-only events. Be creative and innovative when developing your rewards program.

The best thing is you won’t need to partner with a bank and deal with the strict compliance regulations of private-label credit cards.

The Bottom Line

Branded card programs enhance your customers’ shopping experience. They help build customer loyalty and encourage repeat purchases.

Some perks you can offer with a private-label credit card are promotional financing, loyalty rewards, and discounts on future purchases.

You can give customers extended refund periods or allow product returns without receipts.

What’s crucial is to partner with a reputable credit card issuer. After all, you want to gain customers’ trust and establish your brand as credible and reliable.