Do you worry about damaged or lost packages while they’re in transit? You’re not alone.

It’s a major concern, especially for business owners who need timely delivery.

Fortunately, I have good news: shipping insurance can save the day!

The question is: What is shipping insurance?

I wrote this guide to discuss shipping insurance, its benefits, and how it works.

Let’s begin.

What Is Shipping Insurance?

Shipping insurance protects your item if it gets lost, stolen, or damaged during shipping.

It may seem like an extra expense, but it can be worth it when considering the potential cost of a damaged parcel.

Shipping insurance gives you peace of mind that your items are safe if something unexpected happens.

How Does Shipping Insurance Work?

When you purchase shipping insurance, you’re paying a price to protect the value of your parcel.

If your insured package gets lost, stolen, or damaged, you can file a claim with your insurance provider to receive a reimbursement for its value.

Major shipping carriers have limited shipment insurance coverage. It may only cover a portion of the cost of your package, so adding shipping insurance is ideal.

Benefits of Shipping Insurance

Here are the reasons shipping insurance is worth it.

Customer satisfaction

You make customers happy when their items arrive in good condition.

Peace of mind

Insuring your packages eliminates unnecessary stress and worry if your packages get lost, stolen, or damaged.

Improved focus

Insuring your packages gives you one less thing to worry about, letting you focus on more important business tasks.

Shipping Insurance Coverage: What Does It Cover?

As a seller, you want to protect your ecommerce business and the items you ship.

The question is: What does shipping insurance cover?

Coverage can vary by policy and the shipping company, but insurance covers incidents beyond your control.

For example, poor delivery experience (delivery delays), damage to goods, or shipping malpractices before delivery.

Each provider has unique requirements, restrictions, and coverage details.

Review your options carefully, and choose the provider that meets your needs and budget to ensure maximum protection.

How Much Does Shipping Insurance Cost?

How much is shipping insurance?

The shipping insurance rate you get will depend on multiple factors, including the size and weight of your shipment, your shipment method, and the total value of your items.

Major carriers like UPS, FedEx, and USPS offer competitive shipping insurance rates.

USPS Shipping Insurance

USPS insurance costs have a fee with prices based on the declared value, with $5,000.00 as the greatest rate. So, how does usps insurance work? Here’s information about their declared value and insurance costs.

| Declared Value | Insurance Cost |

|---|---|

| $0.01 – $50.00 | $2.65 |

| $50.01 – $100.00 | $3.40 |

| $100.01 – $200.00 | $4.30 |

| $200.01 – $300.00 | $5.65 |

| $300.01 – $400.00 | $7.10 |

| $400.01 – $500.00 | $8.60 |

| $500.01 – $600.00 | $11.50 |

| $600.01 – $5,000.00 | $11.50 plus $1.75 per $100 (or a fraction thereof over $600 in declared value ) |

How much is USPS insurance for $1,000? I manually calculated the cost and estimated that it starts at approximately $11.57.

USPS shipping coverage also includes USPS priority mail, priority mail express, and global express guaranteed.

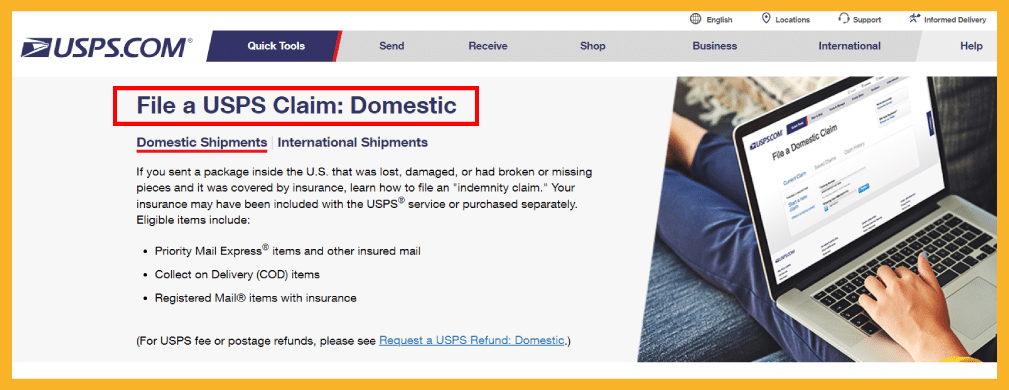

Filing a Claim With USPS

The USPS claims process differs slightly from other shipping carriers.

Here’s how to file a claim with USPS.

Check claim windows according to the mailing date (damage claims within 60 days).

Gather the original mailing receipt, proof of insurance, item value docs, and damage evidence.

File the claim online or by mail. USPS suggests filing online for faster and easier tracking of claims history.

Is USPS Insurance Worth It?

USPS insurance can be a lifesaver if you’re shipping something valuable, but it may not cover everything.

Consider shipping insurance costs and coverage and weigh them against the value of your parcel.

FedEx Shipping Insurance

FedEx shipping insurance cost covers up to $100 in declared value for every service.

| Declared Value | Insurance Cost |

|---|---|

| Up to $100 | $0 |

| $100.01 – $300.00 | $3.90 |

| Each extra $100 in declared value | Extra $1.30 |

When declaring the value of your shipment, the cost varies depending on your location.

FedEx shipping insurance rates with U.S. shipments cost $1.30 per $100 or $1.00 per pound. Meanwhile, international shipping insurance rates cost $9.07 per pound, which can be expensive.

Insurance may not be cost-effective if shipping something heavy or bulky but not worth a significant amount.

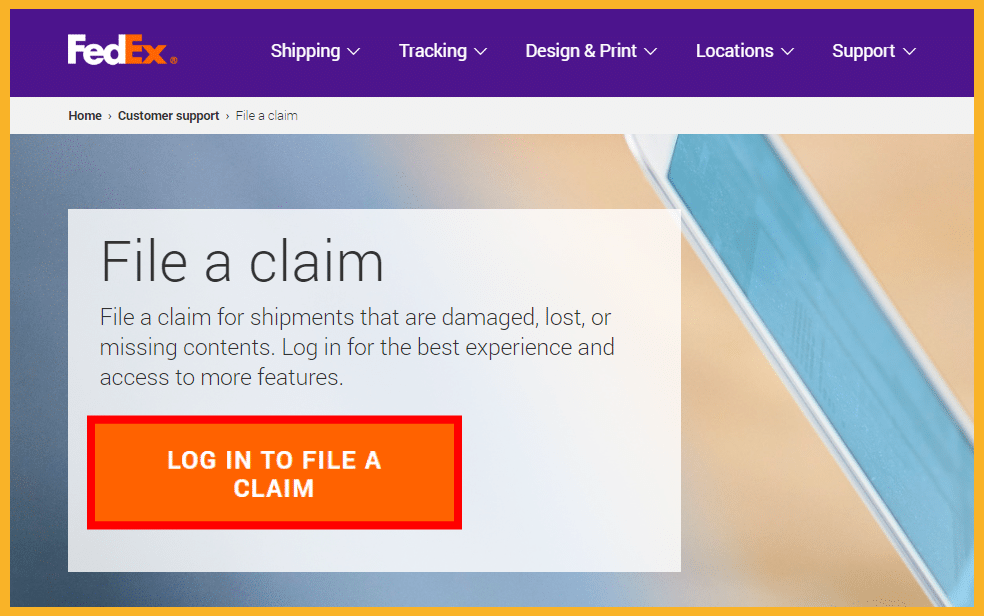

Filing a Claim With FedEx

Here’s how to file a claim with FedEx.

Start your claim online by completing the form and providing your tracking or PRO number and claim type.

Upload documents like bills, serial numbers, and photos to support your claim.

Submit the claim and save the case number page for your records.

For damage claims, include photos of the item and keep the original packaging. You can do a self-inspection form for items between $100 and $1000.

Track your claim online for updates until you receive a resolution.

UPS Shipping Insurance

UPS shipping insurance covers a maximum declared value of $50,000 (or local currency equivalent).

| Declared Value | Insurance Cost |

|---|---|

| Up to $100 | $0 |

| $100.01 – $300.00 | $3.90 |

| Each extra $100 in declared value | Extra $1.30 |

UPS shipping insurance cost covers some larger items if you ship them with UPS. The charges for this coverage can vary based on the declared value.

I manually calculated the cost of other declared values and used these estimated values for insurance costs:

UPS insurance cost for $5,000 is approximately $65.

UPS insurance cost for $3000 is approximately $42.90.

UPS insurance cost for $2,000 is approximately $29.90.

How much is UPS insurance per $100? It’s $1.30

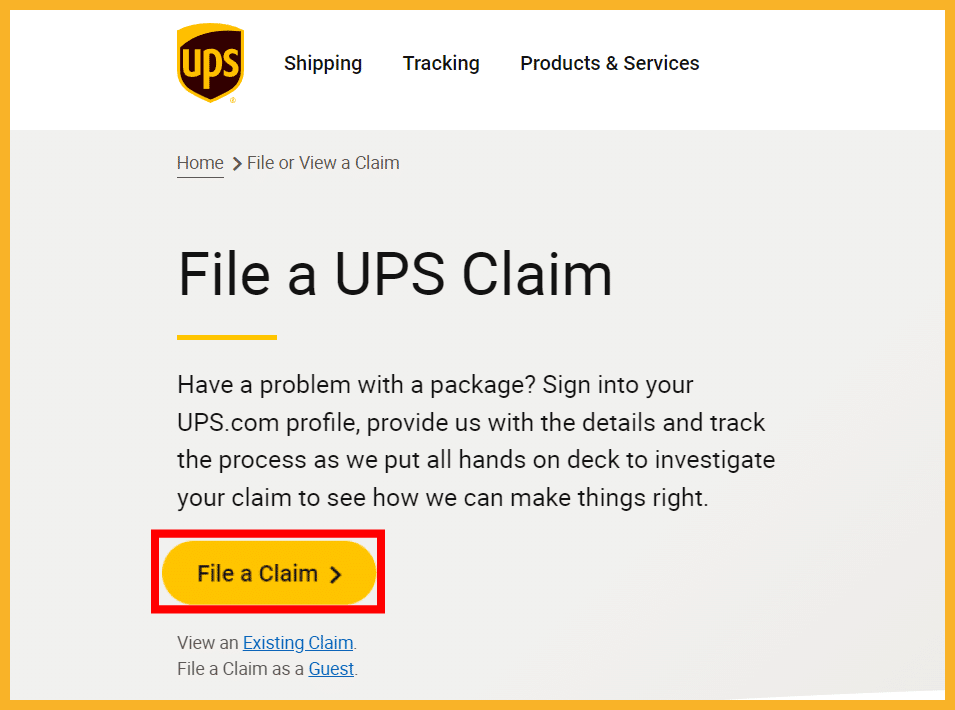

Filing a Claim With UPS

Here’s how to file a claim with UPS.

Provide the package details, like the tracking number, recipient info, and weight.

Identify yourself as the seller if you shipped the package from your business.

Add documentation by uploading item or value-related receipts and invoices

Attach photos showing the damage to support the claim (if applicable).

Track claim online via UPS’s claims dashboard for updates, document uploads, history, etc.

Third-Party Logistics

There are many reasons to use 3rd-party shipping insurance.

Third-party shipping insurance can be more affordable and have easy-to-understand shipping insurance policies.

You may consider Shippo, Cabrella, or Shipsurance as your alternative options.

How Much Does Postal Insurance Cost?

Are you curious about postal insurance costs?

Postal insurance costs depend on the value and destination of your shipment. Though some carriers have free coverage, added protection may include an extra fee.

Double-check your shipment’s insurance and discuss the cost with your carrier.

The Risk of Shipping Without Shipping Insurance

Shipping without insurance might seem like a way to save money, but it could cost you more in the long run. You’ll be empty-handed if your package gets lost or damaged during transit.

Ship your goods with insurance to cover costs if anything happens to your shipments during transit.

Is Shipping Insurance Worth It?

Buying shipping insurance can give you peace of mind. It also allows you for more predictable loss and prevention costs.

Is it worth it?

Yes. Shipping insurance is worth it if you’re shipping expensive or fragile items. Whether you have international or domestic shipments, shipping insurance works.

Frequently Asked Questions (FAQs)

Why Do I Need Shipping Insurance?

The best shipping insurance policies can help you save money.

Without insurance, you pay out of pocket to cover all losses if something happens to your parcel.

Prices can add up, especially if you ship many expensive items.

Who Files the Shipping Insurance Claims?

Either the seller or buyer may file an insurance claim. You must include proof of insurance and have the original receipt if you’re the person filing. File your shipping insurance claim within the carrier’s specified timeframe.

Who Handles Shipping Insurance?

Major carriers have insurance liability and are responsible for shipment delays, damages, and losses.

Is Shipping Insurance Refundable?

No. This insurance policy is non-refundable. Insurance companies will not insure you and return the money when you don’t use it. It’s likely a scam if someone offers you this shipping process or service.

The Bottom Line

I hope this guide helped you learn about shipping insurance and how it works.

Whether you’re a business owner or not, purchasing shipping insurance can help you save costs. Understanding what insured shipping means is the key to protecting your valuable packages during transit.

You can save even more money by considering the cheapest ways to ship packages.