You’ve decided to start your journey toward financial freedom by launching an online business on Etsy.

The question is: Do you need a business license to sell on Etsy?

If you asked yourself this question, don’t worry. You’re not alone. Many Etsy sellers also asked the same question before opening their stores.

You’ve come to the right place.

I created this guide to answer this question and provide more helpful information to make it easier for you to open your Etsy shop.

Let’s begin.

Do You Need a Business License To Sell on Etsy?

If your question is, “Does Etsy require a business license?“

The short answer is no. Etsy’s policies don’t require business licenses for selling on the platform.

However, if your question is more about how to start an Etsy shop legally, then you need a business license.

The licenses and permits you need vary depending on your state and local laws. You must check with your jurisdiction for the specific legal requirements of operating a legal business.

Do You Need an EIN To Sell on Etsy?

Not necessarily.

An Employer Identification Number (EIN) or Federal Tax Identification number allows businesses to file taxes with the IRS or other regulatory bodies in the area.

If you operate your Etsy business as a sole proprietor, you only need your Social Security Number (SSN) for tax identification purposes.

However, you may need an Etsy EIN number in these situations:

You’re registering a partnership or LLC.

You’re hiring employees.

You want to open a business bank account.

You’re required to collect and remit sales tax.

If you’re unsure whether you need an EIN or not, consult with your local small business administration.

Do You Need a DBA for Etsy?

You may need a Doing Business As (DBA) license if you’re a sole proprietor. Some states or local governments may require a DBA license if your Etsy shop name differs from your legal name.

While others don’t require one, this permit allows you to trade under a different name from the legally registered one. You can accept checks written to your DBA name and stop competitors from using your name.

Can You Sell on Etsy Without a Business License?

Yes. As stated, Etsy doesn’t ask for any license or permits when you sign up as a seller. It’s up to you to secure the necessary documents to operate your business legally.

While some sellers operate a successful Etsy business without a license, they might be doing so illegally. Otherwise, they may not need one at all.

How do you know if you need a license?

You need one when running any type of for-profit business, including an online store. However, many sell on Etsy as a hobby, which doesn’t require a business license.

I’ll explain it in more detail below.

What Is a Business Classification?

The IRS decides whether your online venture is a business or a hobby using nine factors, such as:

Whether you operate in a businesslike manner, maintaining books and records

The amount of time and effort you spend on the activity

Your personal motives behind engaging in the activity

Whether your livelihood depends on the income generated from your Etsy shop

Your knowledge in carrying it out as a business

Your history of making profits from similar business activities

The activity’s profitability in some years

Whether you’ll make a profit from the appreciation of your shop’s assets

Whether the losses are normal in the startup phase or beyond your control

In summary, your Etsy shop is a business if you’re monetizing your skills and running it as a business.

When Is Running an Etsy Shop a Hobby?

Simply put, when your primary motive is for recreation or personal enjoyment purposes. You may still earn income but not make a substantial profit and have sporadic sales.

You don’t engage in typical business practices, as well. You don’t maintain records and promote your Etsy shop actively to grow your operations.

When you’re running your Etsy store as a hobby, you don’t need to apply for a business license. However, you must still pay income tax for your shop’s earnings.

The downside is you can’t claim deductions or expenses related to your Etsy shop.

Are Home-Based Businesses Exempt?

Some Etsy sellers might argue they’re exempt from local licensing requirements because they only sell from home and don’t have a business location.

However, all that matters to authorities is that you have a business and sell products. You may not need to license to operate (depending on your location), but you should still expect to pay sales taxes.

You may also need to secure permits for operating a business in your home, such as a home occupation permit or certification of occupancy.

What Do You Need To Sell on Etsy?

There aren’t many requirements to sell on Etsy. To sign up as a seller, all you need to do is register on their website and provide the necessary information.

Some other things you should consider are:

Product offerings. Etsy only allows specific items, such as handmade products, vintage items, and craft supplies.

Payment method. You must have a bank account to receive payments from Etsy.

Shipping setup. Consider the shipping services available in your area and their rates.

The required legal documents are for your local governing bodies, not for Etsy specifically.

How To Apply for a Business License

If you want to operate your Etsy shop legally (which is the correct decision), follow these steps to get a business license.

1- Decide on a Business Name.

First, you must decide on a business name to streamline your license application process. It has to be original – different from all the other registered business names.

Aside from compliance, a unique business name helps set you apart from competitors. It helps you create a distinct brand identity that can help your customers remember you easily.

You must also consider your niche. It must be memorable and related to your products, as it’s a part of your brand.

Note: Your business name is different from an Etsy shop name. It represents your legal entity, but you can also use it as your online store’s name if you want.

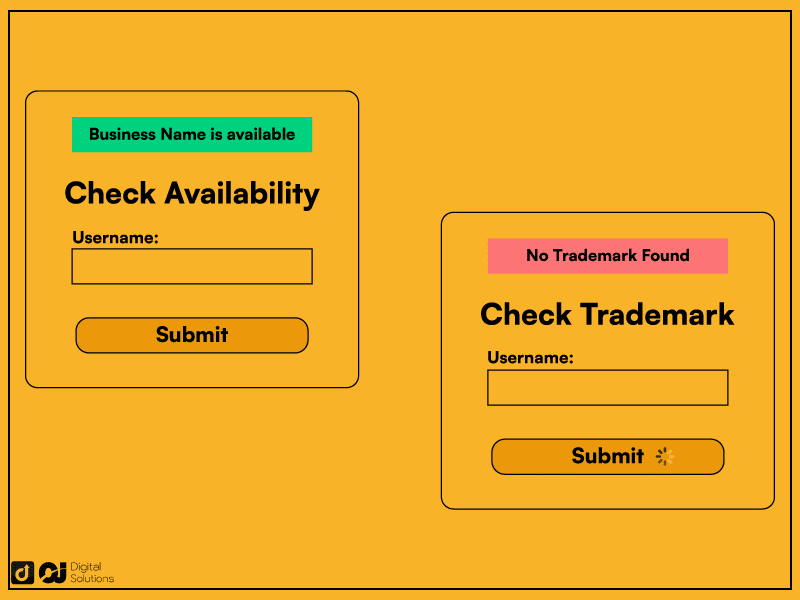

Business Name Verification

Ensure your chosen name is available by checking the business name registration and trademark database.

The Secretary of State’s website should have a tool for looking up the registered business names. You can also check for any regulations surrounding the naming process.

Ensure your desired name doesn’t infringe on intellectual property, as well. Visit the USPTO to see if any words or phrases in the name might have trademark protection.

Register Business Name

Once you’ve settled on a unique name, register it with your local government or the Secretary of State.

You can register in four different ways:

Entity name – provides state-level protection

Trademark – provides federal-level protection

DBA – doesn’t provide legal protection, but might be a part of business license requirements

Domain name – protects your business’ web address

Each can differ from the others, but you can also use the same name for all kinds of registration.

2- Choose Your Business Structure.

The business registration requirements vary depending on your chosen structure.

Sole Proprietorship

An Etsy sole proprietorship is the most popular business structure on the platform.

Being a sole proprietor means you run your own business solo. It’s the simplest business structure and the easiest to operate.

You record all your income and losses on your federal tax return. You assume all legal and financial responsibilities, which means your personal assets, income, and properties aren’t safe in legal disputes surrounding your business.

| ✅ PROS | ❌ CONS |

|---|---|

| It’s easy to set up. | You’re personally liable for business debt and obligations. |

| You’re the sole deciding authority. | You have limited ownership or business transfer options. |

| You have direct ownership of the profits. | It’s difficult to acquire investors. |

Limited Liability Company (LLC)

Operating a limited liability company or LLC allows you to legally separate your personal assets from your business. It also allows you to have multiple members.

An Etsy LLC lowers personal risks, but it still has some characteristics of a sole proprietorship or partnership.

It features pass-through taxation, which means each member still records their income and losses from the Etsy shop in their personal tax returns.

| ✅ PROS | ❌ CONS |

|---|---|

| You can easily scale your business. | It requires more paperwork. |

| You can attract investors. | Registration is more expensive. |

| You don’t have personal liability for your business debt and obligations. | Many deciding authorities might cause disagreements. |

Partnership

Your business is a partnership if you sell online and operate your Etsy store with others. Note that a partnership doesn’t legally have to consist of only two people.

Running an Etsy store as a partnership means splitting business profits and tax responsibilities with your partners. Each of you will have to pay taxes from your profit share.

What makes it different from an LLC is that the partner assumes personal liability for the business’s debt and legal obligations.

| ✅ PROS | ❌ CONS |

|---|---|

| You and your partner(s) share the responsibility and decision-making. | Each partner is personally liable for the business’ debt and legal obligations. |

| You can maximize each partner’s skills and expertise. | More partners can lead to a higher risk of conflicts. |

| It offers more flexibility in management structure and profit-sharing arrangements. | It’s harder to remove or introduce another partner. |

3- Register Your Business.

Once you decide on a name and structure, you can register your business as a legal entity.

You’ll have to register with the state in which you’re conducting your business. Each state has varying requirements and regulations, so first check with your state what documents you need and how to proceed with the business registration.

Some states allow online registrations, while others may require you to submit them in person.

You often need these documents:

Business name

Business location

Ownership, management structure, board of directors

Registered agent

Additional documents depending on your state and business model

How Much Does It Cost To Get a Business Permit?

According to the Small Business Administration (SBA), registering your business shouldn’t cost more than $300. However, depending on your state and business structure, you may have to pay additional fees.

How Long Does It Take To Get a Business License?

It depends on your business type and jurisdiction. Some states can grant you a business license within a week, while it can take months for others.

The process shouldn’t take too long for Etsy sellers registering as sole proprietors. However, it’s best to consult with the local government agency responsible for licensing.

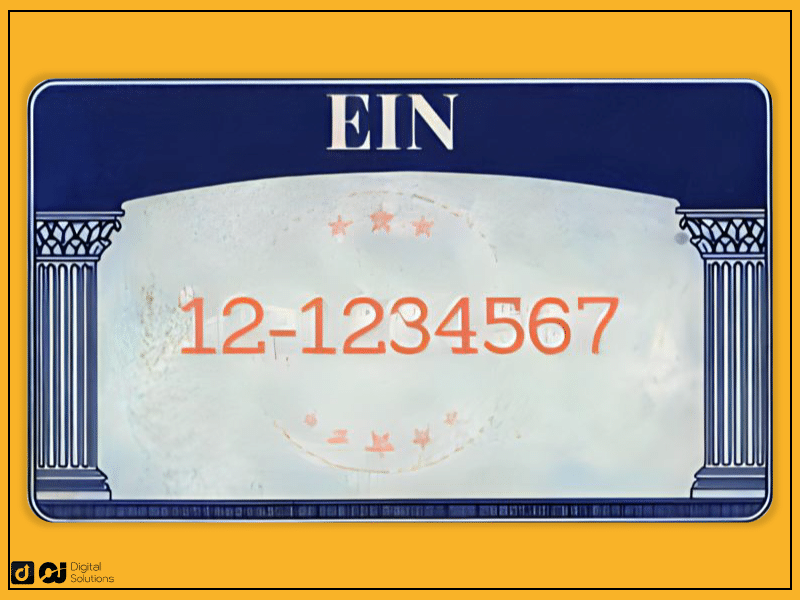

4- Get an Employee Identification Number (EIN).

If you need an EIN, you can apply for one after registering your business.

Application is free; you can do it online via the IRS assistance tool. You’ll immediately receive your nine-digit EIN after verification.

5- Apply for Other Licenses and Permits.

Running an Etsy shop doesn’t need a federal license, although you might need to get one from the state. You might also have to secure other permits, depending on your location.

Here’s a rundown of some licenses and permits you might encounter.

Seller’s Permit

Most states require a seller’s permit, also known as a sales tax permit or a sales and use license. This allows you to sell goods and services to the people in their jurisdiction.

The sales tax regulations vary by state. If your customers are in different states, you must apply for each one.

However, you most likely don’t need to secure a seller’s permit for your shop because of the Etsy collection rules.

In accordance with the Marketplace Facilitator Laws, Etsy now collects the state sales tax for you, then remits it to the authorities. The platform deducts it from your receivable amount in each transaction.

Etsy handles the sales tax obligations in most states, but what if you’re shipping to one without this legislation?

You must apply for a seller’s permit. You need one even if you don’t have a physical presence in that state.

However, you must meet certain conditions first, which vary by state. Here are some sales tax policies to consider:

State’s Laws. Certain states don’t have state tax laws, such as Alaska and Delaware.

Gross Sales. You may not need a permit if you don’t meet a minimum dollar amount (e.g., $100,000) or sales transactions (e.g. 200 individual transactions) within a 12-month period.

If you’re unsure, contact a tax and legal professional.

Home Occupancy Permit

Most online sellers operate their business from home. If you’re one of them, you need a home occupancy permit.

A home occupancy permit helps ensure you comply with your area’s zoning regulations, especially involving activities that can disrupt the neighborhood.

In general, selling online isn’t disruptive as you don’t need a parking space for customers, and you won’t have any visitors.

However, depending on your craft, you might have issues with noise levels from your equipment.

Inquire at your local government authority or zoning department that grants this permit.

HOA Approval

If you live in an HOA-regulated neighborhood, you must check with them first if you can conduct a home-based business.

A homeowners association usually places restrictions on home-based businesses to maintain the neighborhood’s character and land value.

Check your copy of their governing documents to review any specific rules about your Etsy shop. To be on the safe side, ask your HOA directly.

Product-Specific Considerations To Run an Etsy Store

Selling Food on Etsy

You can sell food online on Etsy but must comply with laws and local regulations regarding food preparation, packaging, and sale.

Before you can sell food on Etsy, you might have to acquire the following first:

Food business registration

Food handler’s license for each person involved in making or packaging

Home kitchen inspection by the local health department

Business insurance for basic liability protection

The exact requirements vary by state. For example, not all states require home inspections.

Nonetheless, it’s best to take the prerogative of keeping your kitchen up to standard. Consider proper storage for your ingredients, including dry storage and refrigeration.

Your workspace, processes, and handling must comply with safe food preparation guidelines.

Etsy also reminds sellers to comply with the Food, Drug, and Cosmetic Acts and the Fair Packaging and Labeling Act, which requires a proper label. It must contain:

The ingredients list

Nutrition facts

Net weight and quantity

Business name and location

Product description

No false or misleading claims

If your product contains common allergens, such as peanuts and dairy, you must state it clearly on the label. You must also disclose if you prepared the food in an environment where you handle such allergens.

If you’re planning to ship with Etsy, check with the couriers about their allowed food items and restrictions.

Digital and Physical Products

Physical and digital products don’t have the same business license requirements. When you sell digital downloads, you might not have to collect sales tax because most states don’t have legislation for them.

Aside from tax, here are some legal considerations for each item:

Digital Downloads – licensing terms and copyright considerations.

Physical Products – safety standards, labeling requirements, and shipping regulations.

Contact your local taxing authority for more information.

Frequently Asked Questions (FAQs)

What Is a Business License?

A basic business operation license is a legal document or permit that allows you to operate in your jurisdiction. The state or local taxing authorities usually require it to ensure you comply with their regulations and protect consumers.

Why Do I Need a Business License for My Etsy Shop?

Here are some reasons you might need a business license:

Law Compliance – to ensure you operate your Etsy store legally.

Tax Collection – to ensure you’re fulfilling your tax obligations properly.

Legal Protection – to avoid any legal problems.

Seller Reputation – to enhance your credibility as an Etsy seller.

Do I Need To Register My Etsy Business?

In most cases, yes. If you’re operating your online shop as a profitable business, you must have an Etsy business license. However, you don’t need to register your Etsy business if you only do it as a hobby.

Do I Need a Small Business License To Sell on Etsy as a Hobby?

No, the IRS doesn’t require you to get a business license if you’re operating your Etsy shop for personal enjoyment. However, you still need to pay the applicable taxes on your income from your online store.

Do You Need a Tax ID To Sell on Etsy?

No, if your Etsy business is a sole proprietorship. You can use your SSN for your Etsy shop’s tax obligations. However, you need a tax ID or an Employer Identification Number (EIN) if you’re an LLC.

Do You Need an LLC To Sell on Etsy?

No, you don’t need to form a Limited Liability Company (LLC) to sell on Etsy. You can register your business as a sole proprietorship or partnership. However, an LLC separates your personal assets from your Etsy shop, protecting them from your business’s legal obligations.

Do I Need a Sellers Permit To Sell on Etsy?

It depends. Etsy handles most sales tax obligations in states requiring a seller’s permit. If the state you’re shipping to isn’t one of the covered states, you might need to get one with additional considerations.

Do You Have To Pay Taxes on Etsy Sales?

Yes, you must pay taxes on Etsy sales and any other type of income. The specific tax obligations and rates depend on your jurisdiction.

What Happens If I Sell on Etsy Without a Business License?

Etsy won’t do anything, as it doesn’t require a business license to sell on its platform. Moreover, the IRS may not require it if you’re selling as a hobby. However, you may face legal consequences and penalties if you’re running an Etsy store as a business.

Do You Need a Resale License To Sell on Etsy?

In most cases, no. A resale license is also known as a seller’s permit or sales tax permit. As mentioned, Etsy collects the sales tax on your behalf in most states.

Does Etsy Collect Sales Tax?

Yes, Etsy collects sales tax for sellers in certain states and jurisdictions. The states where Etsy collects sales tax can change over time, so ensure you stay up-to-date by checking the website or consulting a tax professional.

Do You Need a Business License To Sell on Etsy in California?

Yes, you must have a business operation license to sell on Etsy in California. The state has stricter regulations for running an ecommerce business.

The Bottom Line

Hopefully, my article has made it easier for you to understand the different licensing requirements for opening an Etsy shop.

Acquiring a business license isn’t enjoyable, but it ensures a secure and legal way to conduct business.

Spend time learning the specifics of setting up a business in your location. Once you know what you need, don’t hesitate to start your Etsy selling journey.